Public Finance Market Update Trends

National & State Market Update

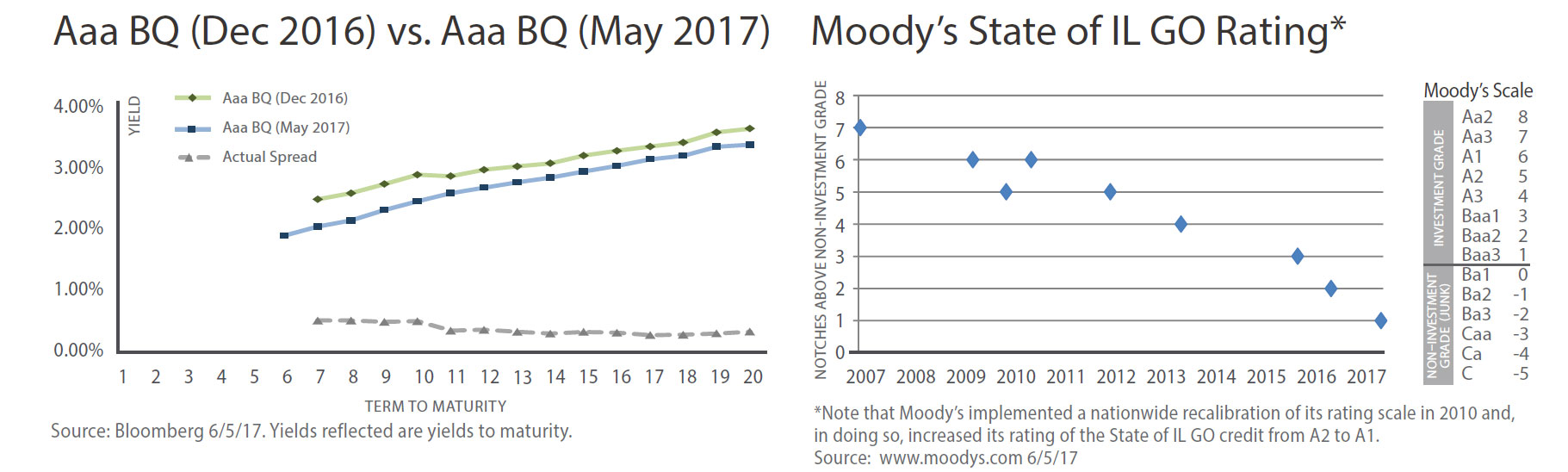

Graph 1, above left, compares two Aaa bank-qualified (BQ) transactions that reflect the degree to which interest rates have decreased since the end of 2016: one deal priced in December 2016 and the other in May 2017. The absolute spreads between the two deals range from 0.20% – 0.45% depending on the term. Much of this can be explained by political uncertainty coming out of Washington, D.C. as investors seek a flight to safety provided by municipal bonds.

We also note the political uncertainty coming out of Springfield, IL as Illinois was recently downgraded by the rating agencies to the lowest available investment grade rating. Graph 2, above right, shows how Moody’s ratings of the State have evolved over the last 10 years. The steady decline reflects the State’s deteriorating credit quality.

Public Finance Market Update: Featured Economic Indicator

GDP Revised Up

Real Gross Domestic Product (GDP) was revised up more than expected to 1.2% from 0.7%. Economists expected GDP to be revised up to only 0.9%. While GDP remained low compared to the last two quarters, business investment was higher in the 1st quarter. The higher than expected upward revision to GDP was largely driven by much stronger investment in intellectual property products including higher spending on research & development. Higher business construction also added to GDP growth. Economists project a rebound in 2nd quarter GDP growth near 3% and first half growth slightly over 2%.

Source: Bloomgerg, www.bea.gov