Public Finance Market Update Trends

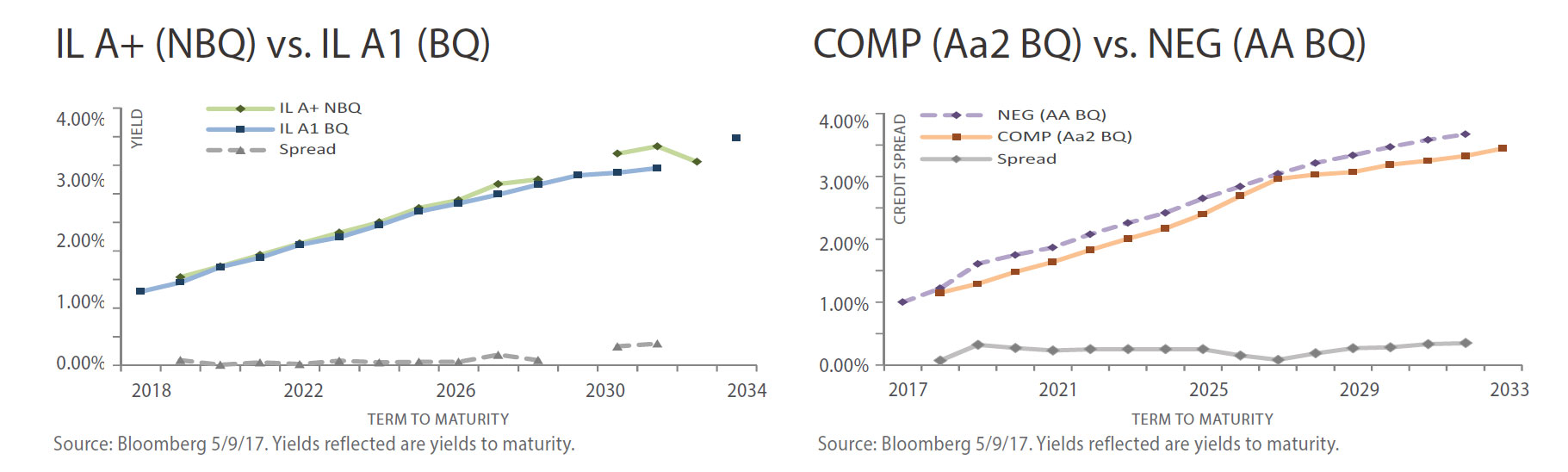

BQ Benefit And Method Of Sale

Graph 1 (above left) sheds light on the benefit of bank-qualified (“BQ”) bond issues by comparing an insured Illinois (“IL”) A+ NBQ bond issue with an insured IL A1 BQ issue. When comparing these two bond issues, the BQ benefit appears to be minimal for the first nine years. In the 10th year, the BQ benefit is approximately 0.18% or 18 basis points (bps) before reaching 38 bps in the 14th year. Graph 2 (above right) shows how the method of sale could impact yields, particularly for higher-rated credits. This graph compares an Aa2 BQ bond issue sold competitively with an AA BQ bond issue sold on a negotiated basis. In the comparison of these two bond issues, the benefit of a competitive sale ranges from 7-35 bps and appears to be fairly consistent throughout nearly every year of the yield curve. This is not surprising given that highly-rated credits tend to perform better in competitive sales relative to negotiated sales.

Source: Bloomberg, www.bea.gov

Public Finance Market Update: Featured Economic Indicator

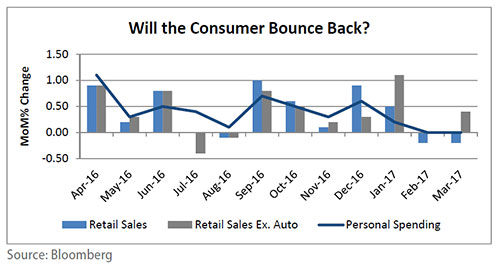

Personal Spending Slows

For two consecutive months, personal spending has been flat on a month-over-month basis. The story has been similar for retail sales and retail sales excluding auto sales. One positive note is that excluding autos, retail sales picked up in March. This was offset by the weakest annualized auto sales in over a year. Diving deeper in the data, a decrease in inflation boosted real spending to a solid 0.3% in March. This increase in real spending was lead by a rise in spending for services. Strong consumer confidence and income growth suggest the weakness is temporary.

Source: Bloomberg, www.bea.gov