Credit Quarterly Recent News

Rising Bank Funding Costs

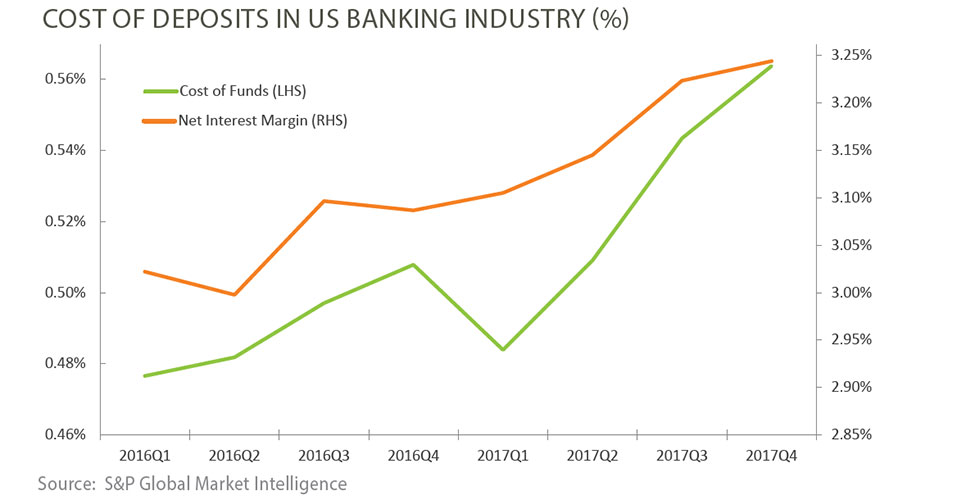

Net interest margin is a measure of the difference between the interest income generated by financial institutions and the amount of interest paid out to depositors and other lenders. It is a key determinant of a bank’s profitability. From a funding perspective, banks have benefited from eight years of nearly 0% interest rates. With three fed funds target rate increases in 2017, depositors have reallocated their money from low yielding accounts to higher yielding accounts causing an increase in the cost of funding for banks.

According to S&P Global Market Intelligence, “much of the shift has been into ‘other’ savings accounts – accounts that permit no transfers by check, draft, debit card or similar order made by the depositor and payable to third parties”. These ‘other’ savings accounts tend to offer higher rates than the traditional savings account. Cost of funds has risen in the fourth quarter to 0.56% compared to 0.51% in the fourth quarter of 2016. It is highly probable that we see a continuation of this trend based on the likelihood of the

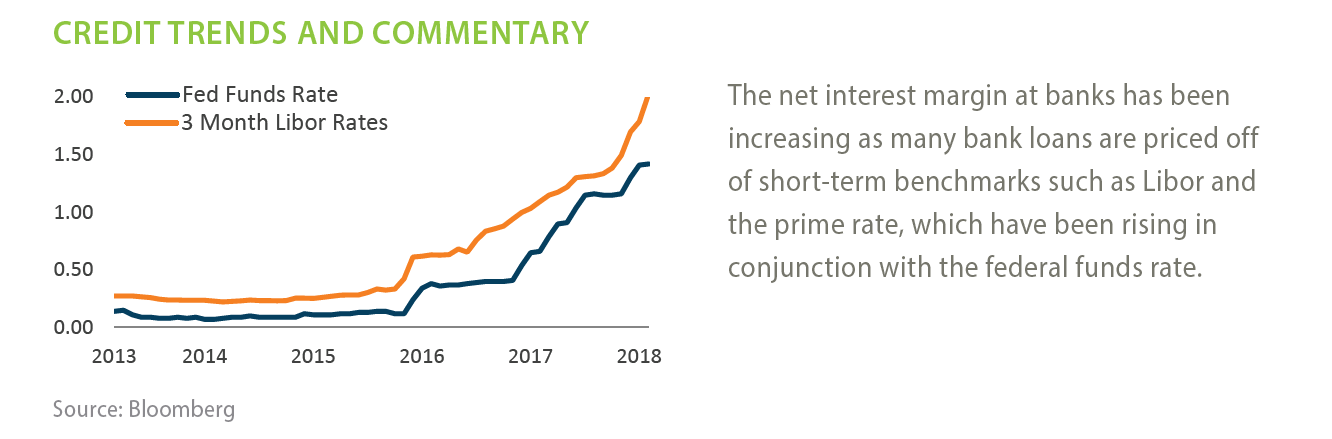

expected interest rate hikes this year. Although the cost of funds has increased, net interest margins are rising as higher lending rates have increased interest income for banks. However as costs increase, banks will experience pressure on net interest margins, inherently affecting their earnings potential.

Credit Quarterly Banking Trends

4th Quarter 2017 Highlights

FDIC-insured institutions reported net income of $25.5 billion, a decrease of $17.7 billion (40.9%) compared with the prior year period. The decrease was mainly driven by higher one-time income taxes enacted from the new tax law. Excluding the tax effects, estimated quarterly net income would have been $42.2 billion, a decrease of 2.3% from a year ago. More than 80% of banks reported year-over-year increases in net interest margin (NIM). Average NIM increased to 3.31% from 3.16% in fourth quarter of 2016, making it the highest quarterly NIM for the industry since the fourth quarter of 2012.

Provisions for loan losses in the fourth quarter totaled $13.6 billion, an increase of $1.1 billion from a year ago as the average net charge-off rate rose slightly to 0.55% from 0.52% the year before due to higher credit card charge-offs. More than a third of institutions reported higher loan-loss provisions than in fourth quarter 2016. Noncurrent balances for total loans and leases increased $1.5 billion (1.3%) during the fourth quarter.

Total assets grew by 3.8% to $17.4 trillion compared with prior year period. Balances in all major loan categories increased with credit card balances experiencing the highest growth. Total equity capital increased by $3.6 billion at year-end 2017. Retained earnings decreased by $4.6 billion due to total declared dividends of $30.1 billion outweighing the quarterly net income of $25.5 billion during the quarter. The number of institutions on the FDIC’s “Problem List” declined from 104 to 95 in the fourth quarter, the lowest number of problem banks since first quarter 2008. For full-year 2017, five new charters were added, 230 institutions were absorbed by mergers, and eight institutions failed.

Source: FDIC: Quarterly Banking Profile

Prudent Man Process

The Prudent Man Analysis

The Prudent Man Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 2: Data Analysis – Qualitative

Bank credit analysis requires insight into a bank’s balance sheet, management and regulatory standing. The composition and quality of assets and liabilities are reviewed, as any balance sheet concentrations can provide insight into a bank’s risk profile. To determine regulatory standing, analysts search for bank

enforcement actions on the FDIC, OCC and Federal Reserve Bank websites. Additionally, if the company is publicly traded, a review of public Securities and Exchange Commission documents is completed.

Qualitative analysis also includes an assessment of industry performance and economic conditions. Banking industry developments are monitored daily and analysts conduct sector analysis within the banking industry to better understand business segments such as commercial real estate, residential

mortgages and credit card lending. Economic trends that may affect bank performance are also monitored.