Public Finance Market Update Trends

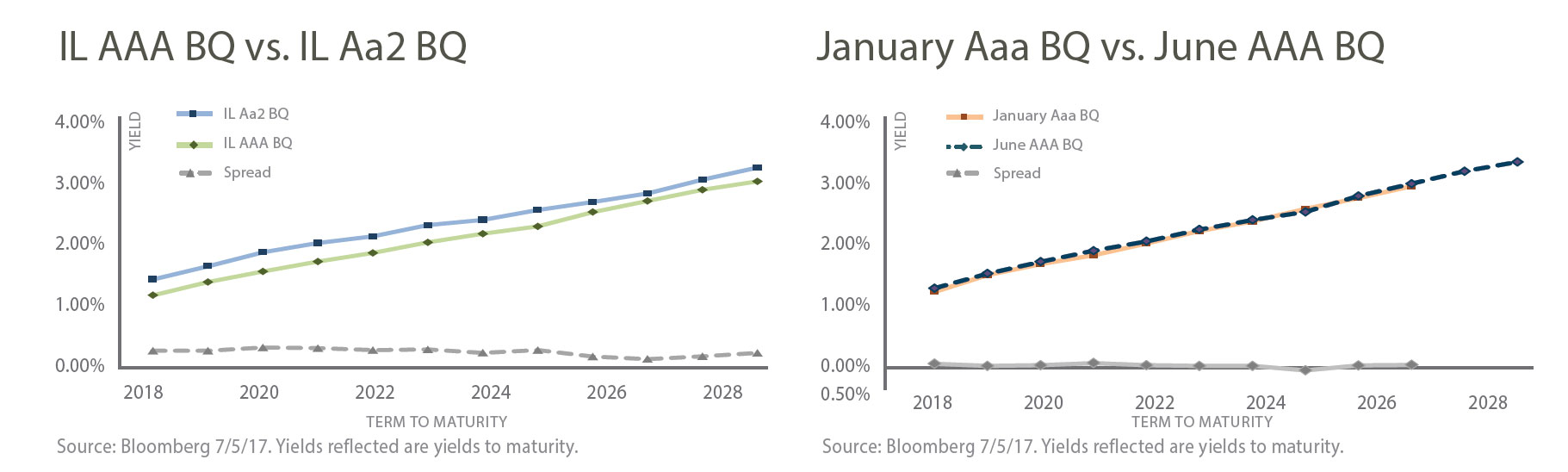

Credit Spreads And Change In IL Impact

Graph 1 (above left) sheds light on the impact of a credit differential between a AAA bond issue and a Aa2 bond issue. The AAA issue sold at approximately 12-30 bps lower than the Aa2 issue, which is expected given the two notch rating advantage. Interestingly, this differential tightened in years 9 through 11 of the yield curve and was wider earlier on the curve. Graph 2 (above right) shows how the impact of the state situation has changed since the beginning of 2017. One may have assumed that the IL impact would have continued to worsen as more time passed without a budget. However, there is virtually no change in spread differential between the January Aaa bond issue and the more recent June AAA bond issue. PMA will continue to monitor these spreads now that the State has passed a budget.

Public Finance Market Update: Featured Economic Indicator

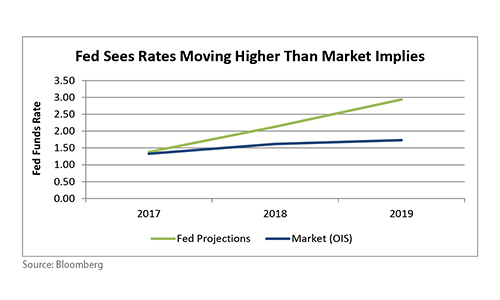

Bond Market Battles Fed

In June, Fed policymakers lifted the Fed Funds Rate to a range of 1.00-1.25% and projected one more increase this year and three more hikes in 2018. Traders in the market for fed funds futures don’t agree. They see a 57% probability that the Fed lifts rates again in 2017. Furthermore, the yield on two-year Treasury bonds implies the Fed will not raise rates over the next two years. The disagreement might stem from economic data. Inflation data has been soft, favoring bond market participants who see little inflation risk. The Fed’s own economic projections showed their preferred inflation measure is expected to come in at 1.6% in 2017, down from 1.9%. But supporting further rate hikes, the Fed’s projections for GDP increased and unemployment projections decreased.

Source: Financial Times, Wall Street Journal, Bloomberg