Public Finance Market Update Trends

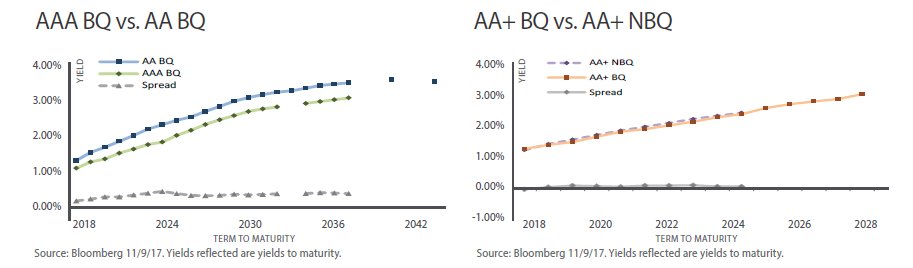

Credit Spread and Negligible BQ Benefit

Graph 1, above left, measures the credit spread between a AAA credit and a AA credit for bond sales in October. As expected, the AA credit sold at higher interest rates throughout the curve. What is slightly surprising is the magnitude of the credit spread, which ranged from 21-47 bps. While this is not completely abnormal, it is slightly wider than one might expect, providing greater emphasis on an issuer’s credit rating. Graph 2, above right, measures the BQ bene t in today’s market by comparing one AA+ BQ bond sale with a AA+ NBQ sale. The comparison shows that the bene t is anywhere from 3-9 bps through the 10-year term, which suggests that the neglibile BQ benefit continues to persist, at least through the early part of the yield curve.

Public Finance Market Update: Featured Economic Indicator

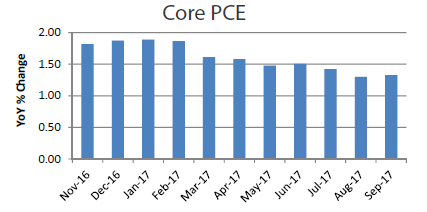

Fed Watching for Inflation

Inflation and inflation expectations are central to monetary policy decisions implemented by the Federal Reserve. Despite stronger economic growth, inflation has remained low, and the Fed’s preferred measure of inflation, Core Personal Consumption Expenditures (PCE) has declined in 2017. Fed Chair Yellen has described the lower inflation in recent months as a “mystery” and expects the “soft readings will not persist.” Central bankers like to see inflation near 2% because it signals a growing economy.

Source: Wall Street Journal