Public Finance Market Update Trends

Low Rates Continue

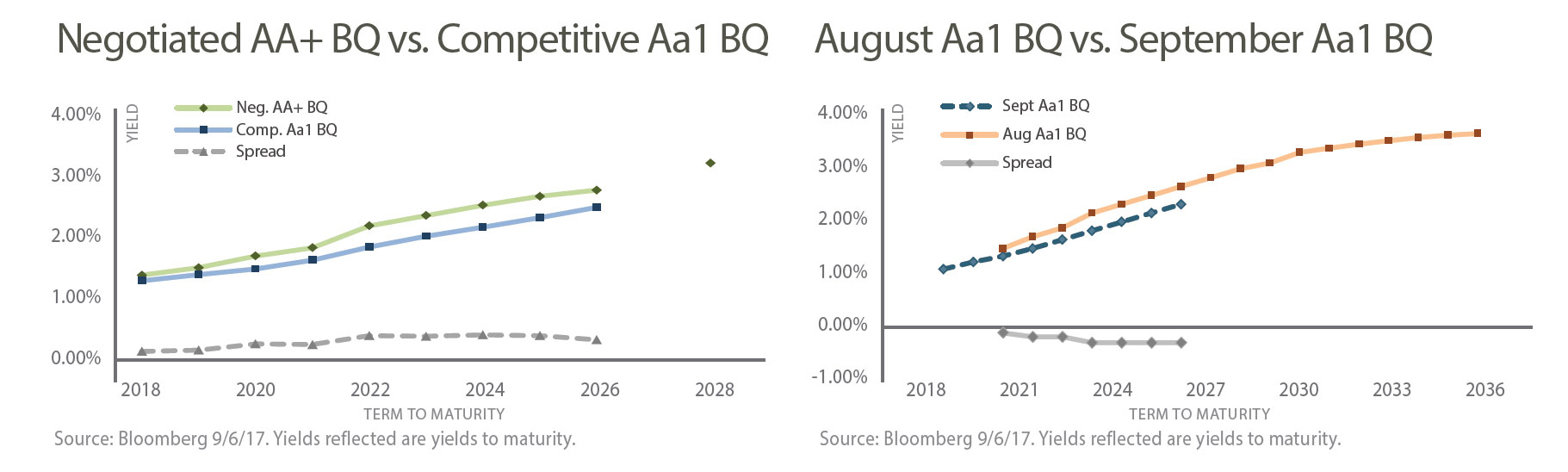

Just as last month, graph 1 (above left) reflects the advantage of a competitive sale over a negotiated sale. This time, the benefit is more pronounced. The AA+ bank qualified (BQ) negotiated sale sold at approximately 30 basis points (bps) wider than the Aa1 BQ competitive sale as early as 2022. The underwriter’s discount as a percentage of the par amount was lower in the competitive sale as well (0.42% vs. 0.89%).

Graph 2 (above right) compares an Aa1 BQ sale in early August with an Aa1 BQ sale in early September and shows that interest rates (and perhaps the Illinois penalty) fell throughout August into early September. While only seven maturities overlapped (2020-2026), the September sale sold at 13-30 bps lower than the August sale. Both issues were sold on a competitive basis and had comparable underwriter discount as a percentage of the par amount (0.42% vs. 0.65%).

Public Finance Market Update: Featured Economic Indicator

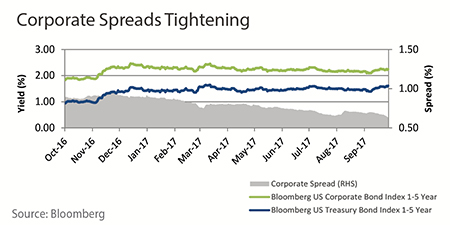

Corporate Spreads Tightening

Corporate spreads, or the difference in yields on a corporate bond and a Treasury bond with a similar maturity, have generally declined over the past year. In part, this reflects strong overall credit conditions as the default rate in the year ended in August fell to 2.9% according to Moody’s Investors Services. However, tightening spreads pose risks for investors who increasingly believe corporate bond yields do not adequately compensate them for credit risk. According to a recent Bank of America Merrill Lynch survey, 81% of global fund managers said corporate bond markets are “overvalued.”

Source: Wall Street Journal