Public Finance Market Update Trends

The Competitive Sale And BQ Bond Advantage

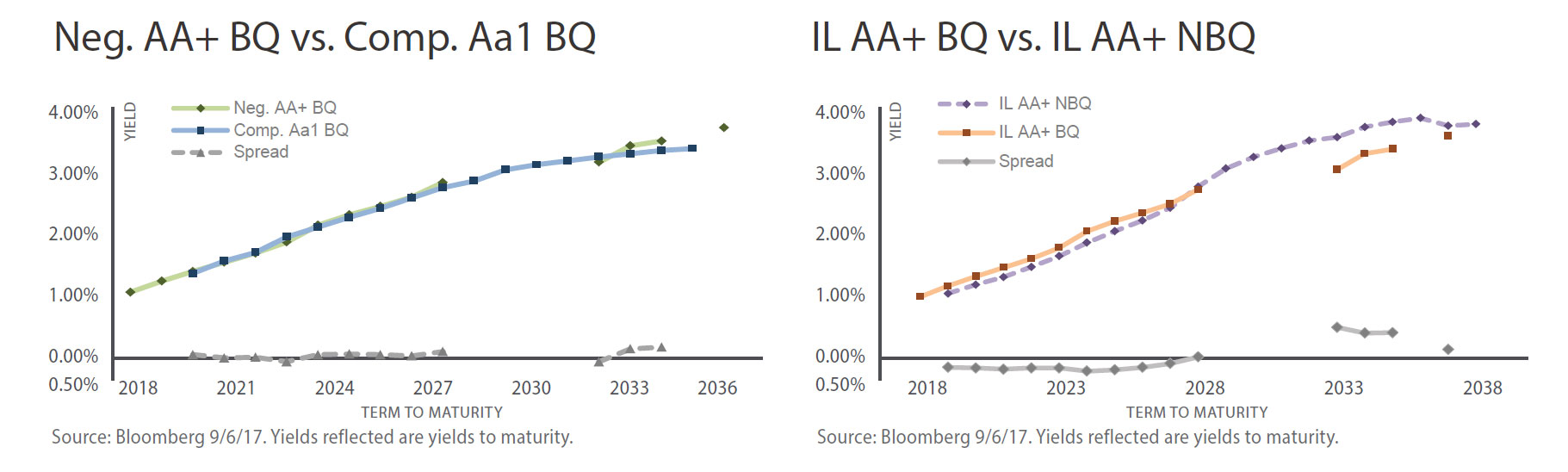

Graph 1 (above left) examines two bond issues from August. One was sold on a negotiated basis and the other on a competitive basis. Both issues were bank qualified (BQ) with similar ratings and par amounts. Interest rates were similar through the first 16 years and then widened to about 12-15 basis points (bps) more for the negotiated issue in years 17 and 18. It should also be noted that the underwriter’s discount on the negotiated sale was slightly higher than its competitive counterpart (0.80% of par vs. 0.66% of par). Graph 2 (above right) examines the BQ benefit in today’s market. Based on the two issues examined, there was minimal difference through the first 10 years, after which the non-BQ issue saw yields that were 40-50 bps wider in the 16-18 year terms.

Public Finance Market Update: Featured Economic Indicator

Low Inflation Could Change FED’s Plans

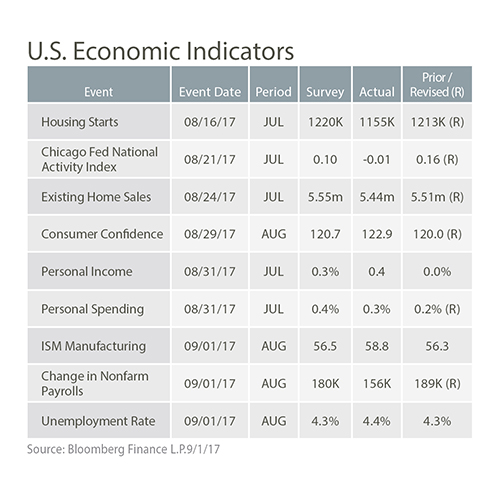

The Consumer Price Index (CPI) for July grew only 1.7% over the past year. Core CPI, which excludes food and energy costs, also grew at 1.7%. The relatively low inflation levels seem contradictory to higher consumer spending, low unemployment and healthy U.S. growth. The chart below shows somewhat higher wage growth, but this has not correlated to higher prices. The Fed’s preferred inflation gauge, the price index for personal-consumption expenditures (PCE), rose only 1.4% in July compared to 2.2% growth earlier this year. The economy’s conflicting signals may change the Federal Reserve’s plans to raise its benchmark interest rate once more before year-end.

Source: www.bls.gov, Wall Street Journal