Credit Quarterly Recent News

Household Borrowing Hits Record High As Costs Climb

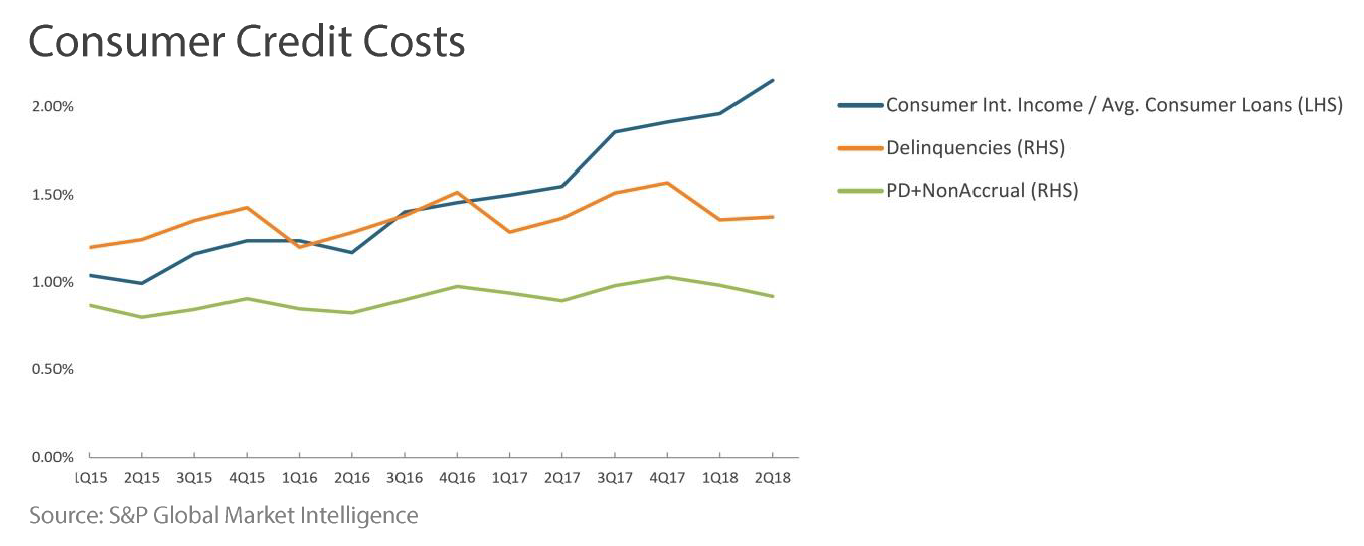

Despite rising interest rates, total U.S. household debt climbed to a record $13.3 trillion in the second quarter of 2018. According to the Federal Reserve Bank of New York, household debt rose by $82 billion in the second quarter from the prior quarter, driven by rising mortgage, credit card and auto balances. Total household debt is now higher than before the financial crisis, when widespread defaults, especially on mortgages, contributed to the longest and deepest recession since the Great Depression. After declining from 2008 – 2013, household debt is now nearly 20% higher than five years ago and has grown for sixteen consecutive quarters. The ongoing growth in home, auto, student and credit card loans has been a result of economic growth and a strong labor market. The steady increase in debt has come as the Federal Reserve has been gradually raising interest rates, which began in December 2015 As a result, consumers have seen their cost of debt increase. Interest income on credit card and other consumer loans at U.S. banks increased to 2.40% in the second quarter of 2018, up from 2.35% in the first quarter of 2018 and 2.09% in the first quarter of 2015. While delinquencies and non-performing assets have remained relatively low, if interest rates continue to rise or the U.S. economy hits a rough patch, U.S. consumers could have trouble making loan payments.

Credit Quarterly Banking Trends

FDIC-insured institutions reported net income of $60.2 billion, an increase of $12.1 billion (25.1%) compared with the prior year period. The increase was mainly driven by lower income taxes enacted from the new tax law and higher net operating revenue. Excluding the tax effects, estimated quarterly net income would have been $53.8 billion, an increase of 11.7% from a year ago. More than 85% of banks reported year-over-year increases in net interest income. Average net interest margin increased to 3.38% from 3.22% in second quarter of 2017. Only 3.7% of institutions were unprofitable during the quarter, the lowest level since the first quarter of 1996.

Provisions for loan losses in the second quarter totaled $11.7 billion, a decline of $293.5 million from a year ago. Almost one third of institutions reported lower loan-loss provisions than in second quarter 2017. Noncurrent balances for total loans and leases decreased $7.7 billion (6.8%) during the second quarter compared to the prior quarter. Average net charge-off rate remained stable at 0.48%.

Total assets grew ever so slightly by $1.3 billion from the previous quarter. Balances in all major loan categories experienced growth. Total equity capital increased by $15.3 billion from the previous quarter. Retained earnings contributed $22.4 billion to equity growth. Declared dividends in the second quarter totaled $37.8 billion, an increase of 33.4% from the same period last year. The number of institutions on the FDIC’s “Problem List” declined from 92 to 82 in the second quarter, the lowest number of problem banks since fourth quarter 2007. During the quarter, two new charters were added, 64 institutions were absorbed by mergers, and zero institutions failed.

Source: FDIC: Quarterly Banking Profile

Prudent Man Process

The Prudent Man Analysis

The Prudent Man Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 3: Assign PMA Rating and Deposit Limits

After all of the data has been gathered and analyzed, each bank is rated on a scale of 1 to 5 (with 1 being the highest and 5 being the lowest). Deposit limits such as day limits on the term for an individual deposit and aggregate dollar limits on deposits per bank are also applied.

The PMA rating reflects PMA’s opinion of a bank’s complete financial profile. The firm believes current financial performance alone often does not tell the entire story of a bank’s risk profile. Banks currently displaying strong performance may hold exceptionally high levels of risk. Conversely, some currently underperforming banks may hold acceptable levels of risk and represent a prudent investment for public funds. A thorough understanding of the banking industry and a detailed knowledge of each bank enable PMA to make informed judgments of the creditworthiness of each bank within PMA’s network.