Investment Advisory Services Featured Market Data

Inflation Remains Below The FED’s Target

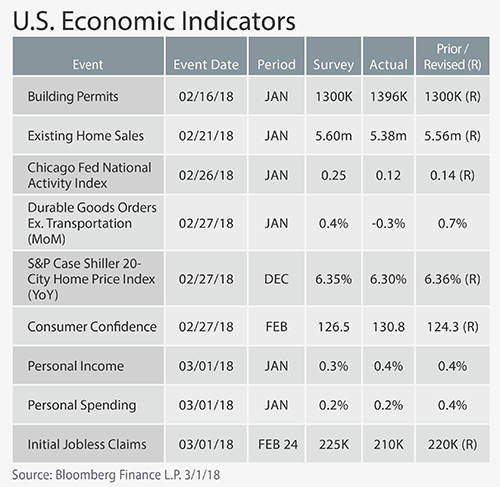

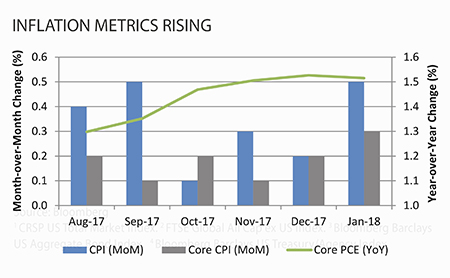

Some measures of inflation have risen at a faster pace in recent months, but overall, inflation remains relatively low. In a report released on March 1st, the Fed’s preferred price gauge, core personal consumption expenditures (PCE), excluding food and energy, was up 1.5% from January 2017. The measure remains below the Fed’s target of 2%. Core consumer price index (CPI) has also increased in recent months. A focus on inflation has increased following the new tax law that took effect in January. We expect the resulting higher after-tax personal incomes to put upward pressure on price growth.

Source: Wall Street Journal, Bloomberg

Investment Advisory Services Recent News

Meeting Chairman Powell

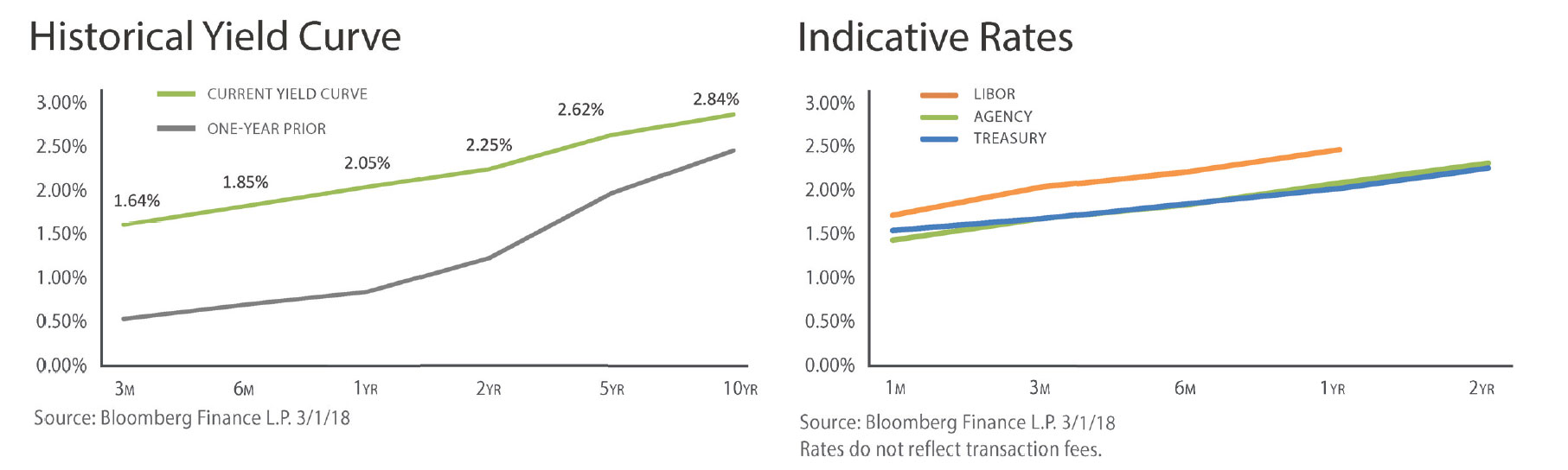

Federal Reserve Chairman Jerome Powell made his first public appearance before Congress on February 28. In his prepared remarks, Powell said, “Some of the headwinds the U.S. economy faced in previous years have turned into tailwinds.” The Chairman later expanded stating, “My personal outlook for the economy has strengthened since December.” He cited continuing strength in the labor market, inflation moving toward the target, continued economic strength around the globe and more simulative fiscal policy. The market viewed Powell’s remarks as more hawkish. Based on Fed Funds Futures, the chance of the Fed raising rates four times this year jumped to more than 30%, about triple the levels seen at the start of February.

Source: Wall Street Journal, Bloomberg, Financial Times