Investment Advisory Services Featured Economic Indicator

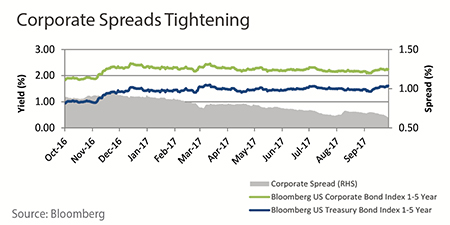

Corporate Spreads Tightening

Corporate spreads, or the difference in yields on a corporate bond and a Treasury bond with a similar maturity, have generally declined over the past year. In part, this reflects strong overall credit conditions as the default rate in the year ended in August fell to 2.9% according to Moody’s Investors Services. However, tightening spreads pose risks for investors who increasingly believe corporate bond yields do not adequately compensate them for credit risk. According to a recent Bank of America Merrill Lynch survey, 81% of global fund managers said corporate bond markets are “overvalued.”

Source: Wall Street Journal

Investment Advisory Services Recent News

FED Plans To Shrink Balance Sheet

The Federal Reserve confirmed in September that it will begin shrinking its balance sheet in October. The Fed’s balance sheet has grown substantially through a program known as Quantitative Easing, which was intended to help keep interest rates low. The balance sheet wind-down will begin by allowing $10 billion of securities to mature every month without reinvesting the principal. The Fed’s clearly articulated plan should provide a level of market stability, but the full market impact is unknown. Less buying by the Fed may push up long-term rates somewhat. This impact may be offset by investors who view the Fed’s wind-down as slowing growth, reducing inflation expectations and ultimately placing downward pressure on long-term rates.