Investment Advisory Services Featured Economic Indicator

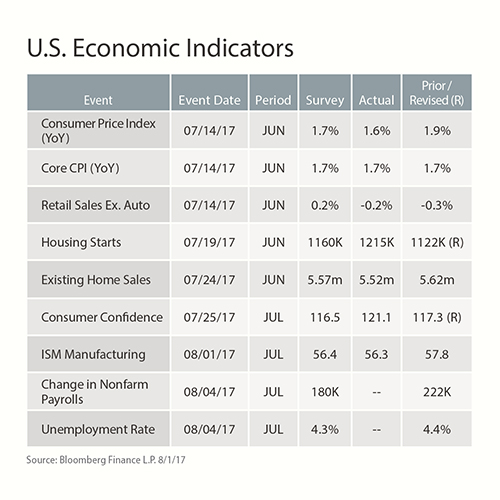

Low Inflation Could Change FES’s Plans

The Consumer Price Index (CPI) for July grew only 1.7% over the past year. Core CPI, which excludes food and energy costs, also grew at 1.7%. The relatively low inflation levels seem contradictory to higher consumer spending, low unemployment and healthy U.S. growth. The chart below shows somewhat higher wage growth, but this has not correlated to higher prices. The Fed’s preferred inflation gauge, the price index for personal-consumption expenditures (PCE), rose only 1.4% in July compared to 2.2% growth earlier this year. The economy’s conflicting signals may change the Federal Reserve’s plans to raise its benchmark interest rate once more before year-end.

Source: www.bls.gov, Wall Street Journal

Investment Advisory Services Recent News

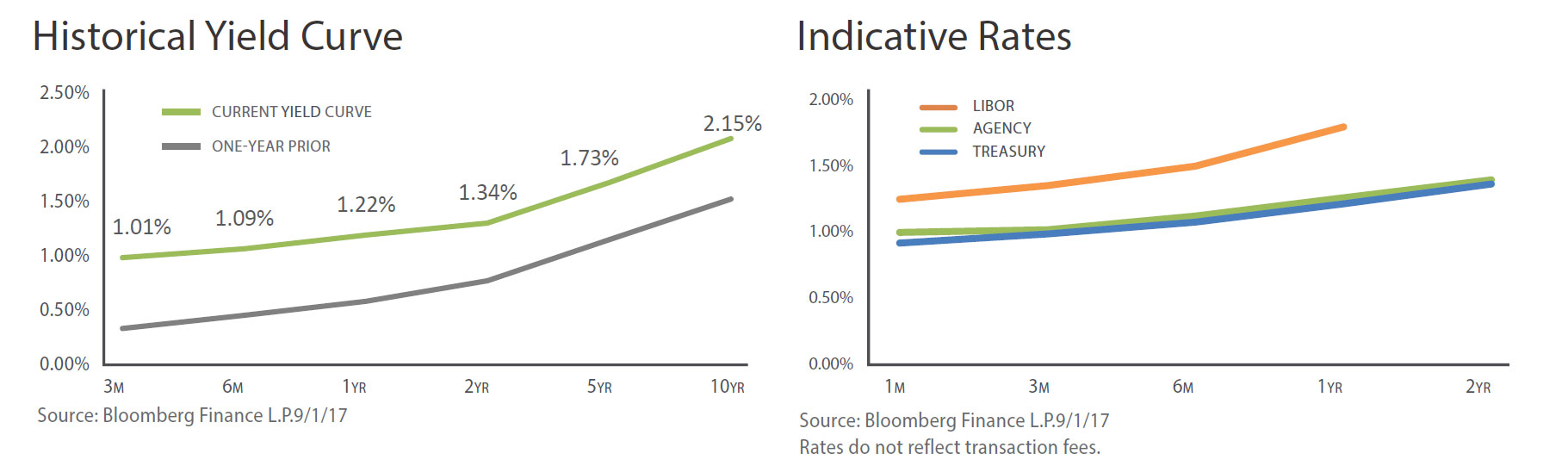

Rates Rally In September

U.S. Treasury yields continued to fall in August due in part to a flight to quality related to rising political unrest. The 10-year Treasury fell to its lowest level of the year when North Korea fired a ballistic missile over Japan near the end of August. This concluded a difficult month as markets also dealt with Hurricane Harvey’s impact on energy markets as well as a variety of issues out of Washington including a failure to repeal and replace the Affordable Care Act and threats by President Trump to shut down the government to secure funding to build a wall along the Mexican border.

Source: Wall Street Journal, Bloomberg