Investment Advisory Services Featured Economic Indicator

Outlook Differs Between Stocks And Bonds

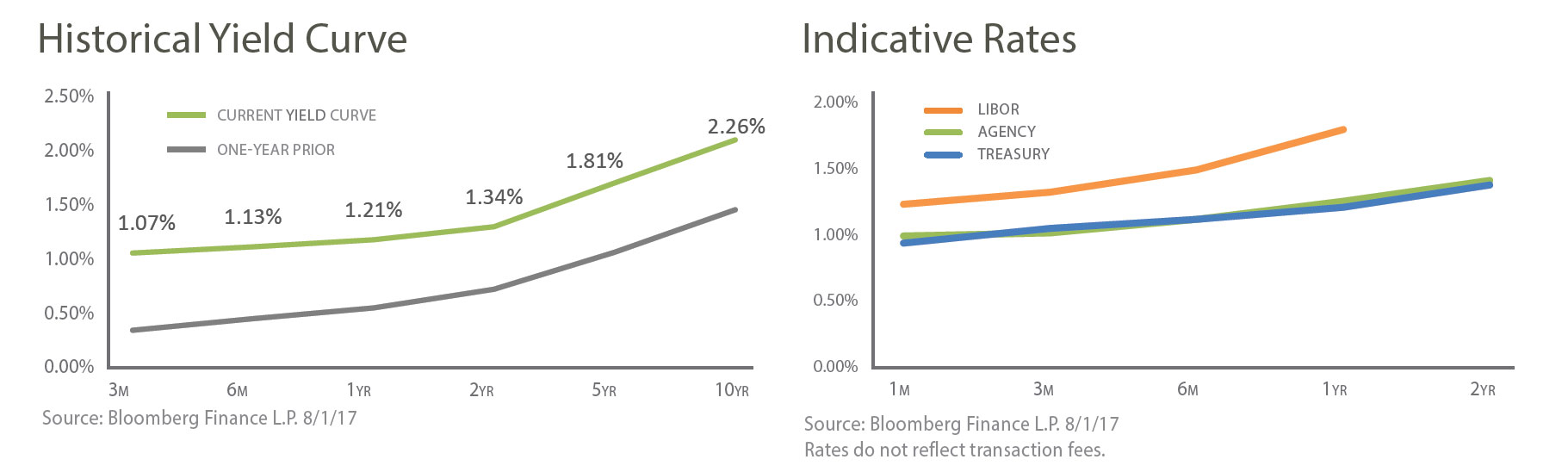

The stock market continues to move higher on stronger consumer and business confidence, driven in part by President Trump’s pro-growth policies. The bond market is sending the opposite message and reflects significantly less optimism about economic growth. Given this divergence in views, we wouldn’t be surprised to see volatility return to markets. Former Fed Chair Alan Greenspan believes bonds are over-priced. In a recent interview, he said, “By any measure, real long-term interest rates are much too low and therefore unsustainable. When they move higher they are likely to move reasonably fast.”

Source: Bloomberg, Prudent Man Advisors, Inc.

Investment Advisory Services Recent News

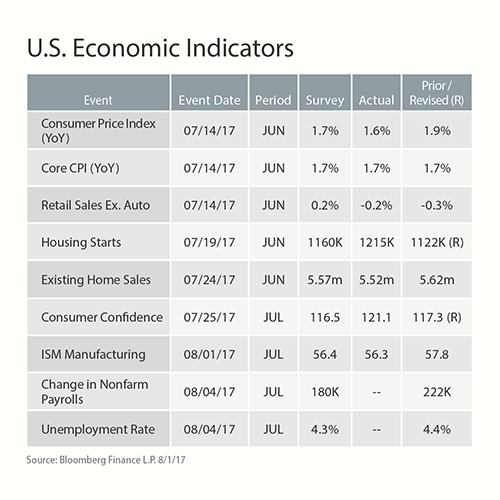

All Business Spending Aids 2Q GDP Growth Test

Real gross domestic product increased at an annual rate of 2.6% in the second quarter. Continued strength in corporate spending helped propel 2nd quarter GDP growth over the weaker 1st quarter level. Businesses spent heavily on computers and industrial equipment, which could lift productivity and spur future economic growth. U.S. exports expanded faster than imports in a sign of an improving global economy. Consumer spending improved from the 1st quarter, though spending on home building and improvements was a drag on growth. A smaller decrease in inventory and higher government spending were large contributors to 2nd quarter growth.

Source: Wall Street Journal, www.bea.gov