Public Finance Market Update Trends

The Value of a Trusted Advisor–Part 2

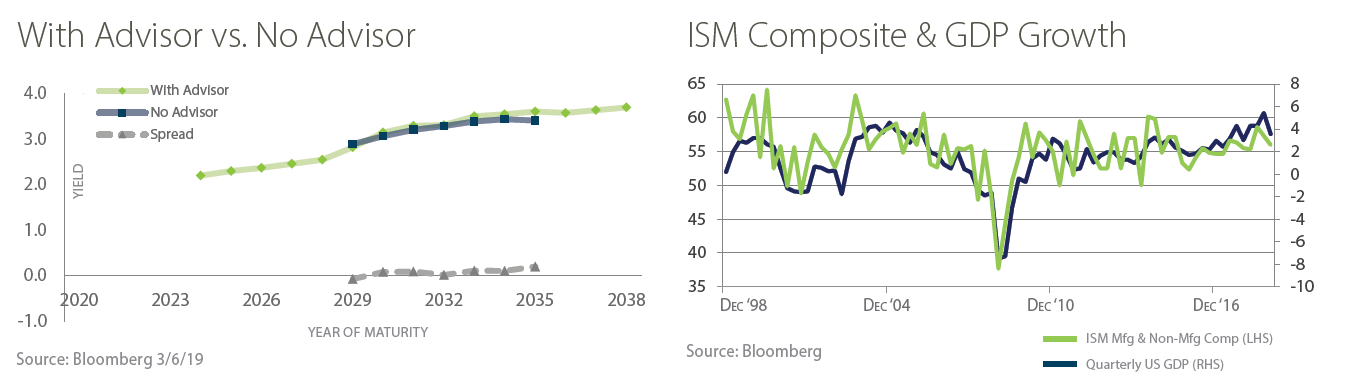

This update is a continuation of our January issue which analyzed the value of a municipal advisor (FA) by comparing two similar transactions; one that used an FA and another that did not. In this month’s analysis, we look at two very different transactions, differences which also include the use of an FA.

The first issue had the following characteristics:

(i) no FA and no insurance;

(ii) rated Aaa by Moody’s;

(iii) bank-qualified (BQ) tax status (lower interest rates than Non-BQ);

(iv) negotiated sale type;

(v) Underwriter’s Discount (UD) (fee paid to Underwriter) was 0.835% of the par amount.

The second issue had the following characteristics:

(i) FA and insurance were used;

(ii) Aa3 by Moody’s (three notches below Aaa);

(iii) Non-BQ tax status;

(iv) competitive sale type;

(v) UD and FA fee, in aggregate, was 0.710% of the par amount.

One might expect the first issue to sell at interest rates notably lower than the second issue, but that’s not what the results showed. Not only did the presence of the FA reduce upfront costs of the transaction, but the results indicate that the two transactions sold at very similar interest rates. The higher-rated issue performed better at most (though not all) maturities, but only marginally so, and not nearly to the extent that one would expect with a higher credit rating and a more favorable tax status, even after accounting for the insurance on the deal with the FA.

Source: Bloomberg

Public Finance Market Update: Featured Economic Indicator

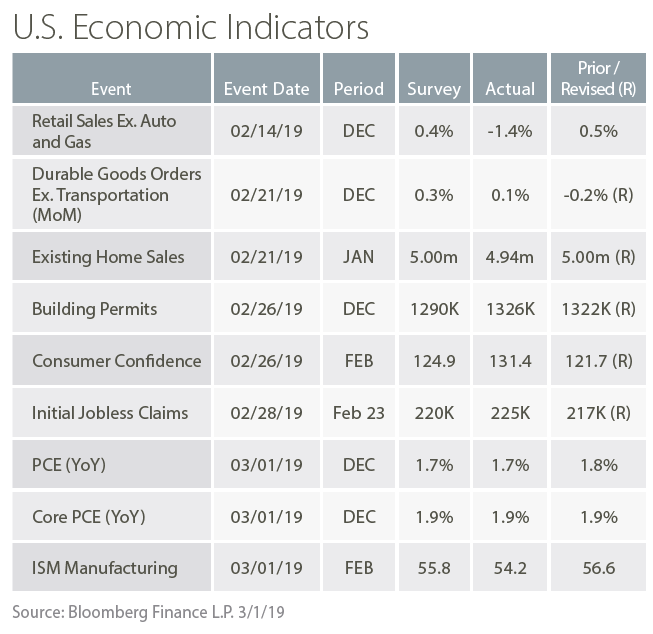

Manufacturing Still Matters

Growth declined at U.S. manufacturing firms in February. The ISM manufacturing index fell to 54.2 in February, a two-year low and below market expectations of 55.8. Four of the five primary components: orders, employment, production and deliveries, all declined. The weakness was attributed to colder than usual weather and policy uncertainty over trade. While the strength of the manufacturing sector may serve as a good proxy for the health of the economy, it is important to note that the pace of growth has ebbed in line with overall economic activity.

Source: Wall Street Journal, Bloomberg