Public Finance Market Update Trends

Declining Interest Rates, Increasing Financial Disclosures

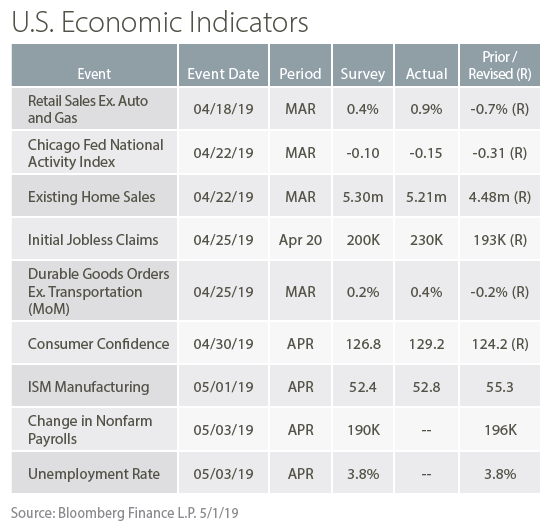

The graph above-left compares the Bloomberg municipal AAA interest rates from 1/3/19 with those from 5/3/19. Interest rates have come down by as much as 0.42% in the 19-year term (2038). As the Federal Reserve maintains a very conservative approach to changes in the Fed Funds Rate, this downward trend in interest rates is likely to remain. Recent global news of an economic slowdown due to deteriorating trade negotiations between the US and China reinforces this pattern as the long-end of the yield curve complements the low rates on the short-end.

The graph above-right shows the change in financial disclosures as reported on EMMA between 2010 and 2018. The number of reported disclosures increased significantly, increasing by nearly 56%, which reflects the heightened priority that the SEC and the MSRB are placing on the disclosure practices in the municipal bond market. Note that disclosures through April are higher in 2019 than in 2018.

Public Finance Market Update: Featured Market Data

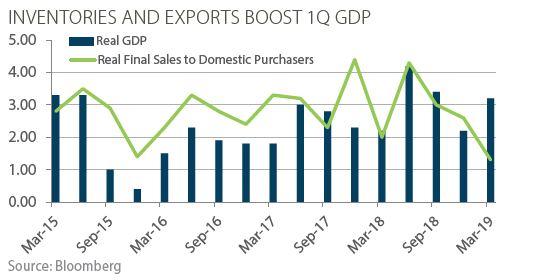

GDP May Fall From Strong Q1

Rising exports, lower imports and higher inventory offset weaker growth in consumer spending and business investments. Final sales to domestic purchasers rose only 1.3% for the quarter. This measure of domestic demand fell for the third consecutive quarter. Despite some underlying weakness, the GDP report exceeded much lower expectations from earlier this year. The report also showed that core personal consumption expenditures (PCE) rose only 1.3% in the 1st quarter. This level is well below the Fed’s target of 2%. The chance of a Fed rate cut by year-end rose to 67% following the report.