Credit Quarterly Recent News

Fed Issues Warning About Leveraged Lending

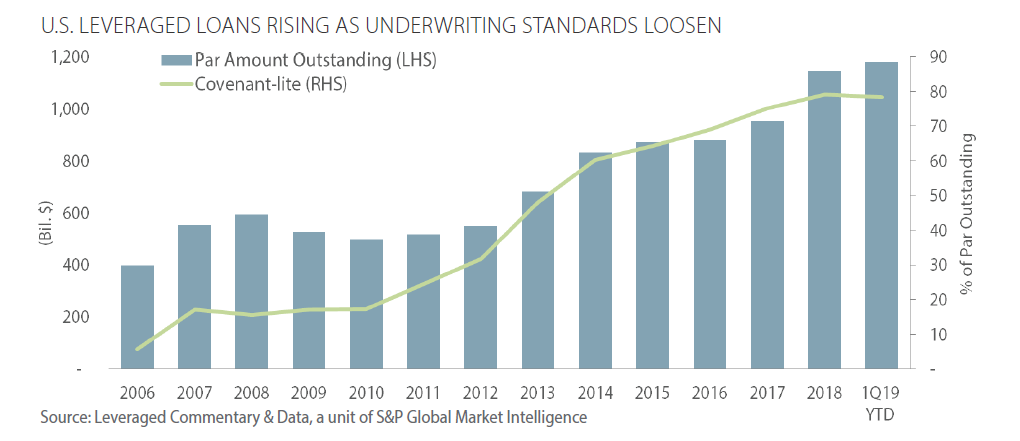

In May, the Federal Reserve released a report that identified rising sales of leveraged loans as a top vulnerability facing the U.S. financial system. The Fed’s report said leveraged lending – defined as lending to companies whose debt exceeds four times their earnings before interest, tax, depreciation and amortization (EBITDA) – increased 17% from the prior year to $1.2 trillion, an all-time high. Typically, a leveraged loan is utilized to finance a buyout, merger or acquisition, a capital distribution, or is used to refinance existing debt. In addition to the rapid growth, there has been a steady decline in underwriting standards as 78% of all leveraged loans are now “covenant-lite,” which means they lack written safeguards for creditors, and a record 40% of newly issued loans in the first three months of 2019 went to companies whose debt exceeds six times their EBITDA. These loans could exacerbate an economic slowdown as highly levered corporations may need to cut jobs and investment spending. The report noted that default rates on leveraged loans currently remain low at 1%, reflecting the relatively strong economy. Leveraged loans are largely held outside of the banking system as U.S. banks hold approximately $89 billion of the market, which comprised 0.9% of total industry loans and 4.6% of total risk-based capital.

Credit Quarterly Banking Trends

1st Quarter 2019 Highlights

FDIC-insured institutions reported first quarter 2019 net income of $60.7 billion, an increase of $4.9 billion (8.7%) compared with the prior year period. The improvement in net income was led by higher net interest income, which reflected a modest growth in interest-earnings assets and wider net interest margins. More than 62% of banks reported year-over-year increases in net interest income. Average net interest margin increased to 3.42% from 3.32% in first quarter 2018. Less than 4% of institutions were unprofitable during the quarter, unchanged from the year prior.

Provisions for loan losses in the first quarter totaled $13.9 billion, an increase of $1.5 billion from a year ago. Slightly more than one third of institutions reported higher loan-loss provisions than in first quarter 2018. Noncurrent balances for total loans and leases increased $462 million (0.5%) during the first quarter compared to the prior quarter, led by a 22.8% rise in noncurrent commercial and industrial loans. The average net charge-off rate remained unchanged from a year earlier at 0.50%.

Total assets rose by $147 billion (0.8%) from the previous quarter. Assets in trading accounts increased by $94.2 billion (16.5%), the largest quarterly dollar increase since first quarter 2008. Total equity capital increased by $36.9 billion from the previous quarter. Declared dividends in the first quarter totaled $38.6 billion, an increase of 26% from the same period last year. The number of institutions on the FDIC’s “Problem List” declined from 60 to 59 in the first quarter, the lowest number of problem banks since first quarter 2007. During the quarter, one new charter was added, 43 institutions were absorbed by mergers, and zero institutions failed.

Source: FDIC: Quarterly Banking Profile

Prudent Man Process

The Prudent Man Analysis

The Prudent Man Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 2: Data Analysis – Qualitative Data

Bank credit analysis requires insight into a bank’s balance sheet, management and regulatory standing. The composition and quality of assets and liabilities are reviewed, as any balance sheet concentrations can provide insight into a bank’s risk profile. To determine regulatory standing, analysts search for bank enforcement actions on the FDIC, OCC and Federal Reserve Bank websites. Additionally, if the company is publicly traded, a review of public Securities and Exchange Commission documents is completed.

Qualitative analysis also includes an assessment of industry performance and economic conditions. Banking industry developments are monitored daily and analysts conduct sector analysis within the banking industry to better understand business segments such as commercial real estate, residential mortgages and credit card lending. Economic trends that may affect bank performance are also monitored.