Recent News

Mortgage Rates Reach 13-Year High

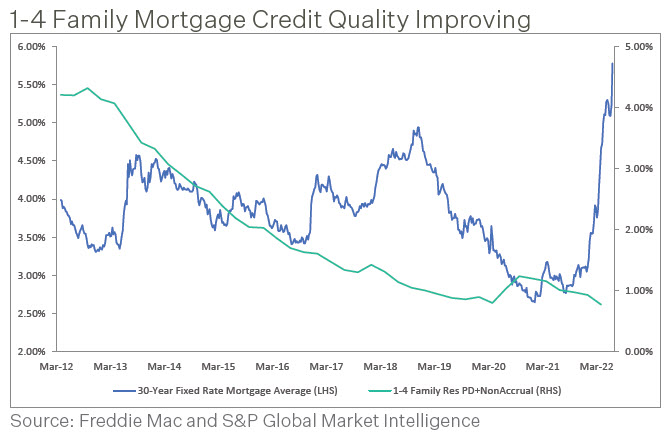

In June, 30-year fixed mortgage rates hit 5.78%, the highest level since November 2008 and well above the 3.11% recorded near the end of last year. This is due to the Fed’s efforts to combat inflation by raising rates. A 6% mortgage rate isn’t high by historic standards as rates hovered between 5% – 7% during much of the decade before the financial crisis, but a return to more normal lending rates has slowed the residential real estate market. New single-family home sales in the U.S. plunged 26.9% on an annual basis in April, according to the U.S. Census Bureau and the U.S. Department of Housing and Urban Development. Likewise, privately owned, single-unit housing starts slipped 7.3% month over month in April but increased 3.7% on a yearly basis. Despite the increase in mortgage rates, home prices remained elevated in the first quarter and credit quality remained pristine. The S&P CoreLogic Case-Shiller National Home Price Index, which measures average home prices in major metropolitan areas across the United States, rose 21.2% YOY in March, up from the previous month’s 20.3%. There are no signs of weakening bank asset quality as non-performing 1-4 Family Real Estate loans at U.S. banks remained low at 0.78% in the first quarter of 2022, down from 1.16% the prior year.

Banking Trends

FDIC-insured institutions reported first quarter 2022 net income of $59.7 billion, a decrease of $17 billion (22.2%) compared with the prior year period. The decrease was primarily due to an increase in provision expense, increasing from -$14.5 billion to $5.2 billion (up 135.8%) from the year-ago quarter. Despite the aggregate increase, only one-fourth of all institutions (25.2%) reported higher provisions compared with the year-ago quarter. Most banks (62.8%) reported a decline in net income from the year-ago quarter.

Noncurrent balances for total loans and leases decreased $4.5 billion (4.5%) from fourth quarter 2021. The average noncurrent rate was 0.84% during the first quarter, down five basis points from the prior quarter. The net charge-off rate declined by 12 basis points from a year ago to 0.22%.

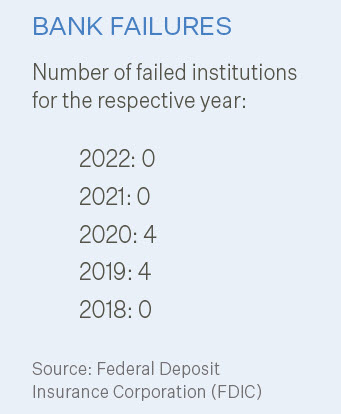

Total assets rose by $253.9 billion (1.1%) from the previous quarter. Total loans and leases increased $109.9 billion (1.0%) from fourth quarter 2021, while securities rose $14.6 billion (0.2%). Total equity capital decreased by $99.6 billion (4.2%) from the previous quarter. Banks distributed 48.3% of first quarter earnings as dividends, which were down $12.6 billion (30.4%) from fourth quarter 2021. The number of institutions on the FDIC’s “Problem List” declined by four from the fourth quarter to 40, the lowest level on record in the Quarterly Banking Profile (QBP). Total assets of problem banks increased to $173.1 billion from $170.1 billion the prior quarter. During the quarter, three new charters were added, 44 institutions were absorbed by mergers, and zero institutions failed.

Source: FDIC: Quarterly Banking Profile

The PMA Report

PMA Credit Research Process

The PMA Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 3: Assign PMA Rating and Deposit Limits

After all of the data has been gathered and analyzed, each bank is rated on a scale of 1 to 5 (with 1 being the highest and 5 being the lowest). Deposit limits such as day limits on the term for an individual deposit and aggregate dollar limits on deposits per bank are also applied.

The PMA rating reflects PMA’s opinion of a bank’s complete financial profile. The firm believes current financial performance alone often does not tell the entire story of a bank’s risk profile. Banks currently displaying strong performance may hold exceptionally high levels of risk. Conversely, some currently underperforming banks may hold acceptable levels of risk and represent a prudent investment for public funds. A thorough understanding of the banking industry and a detailed knowledge of each bank enable PMA to make informed judgments of the creditworthiness of each bank within PMA’s network.