Recent News

CD Rates Fall Behind Fed Rate Hikes

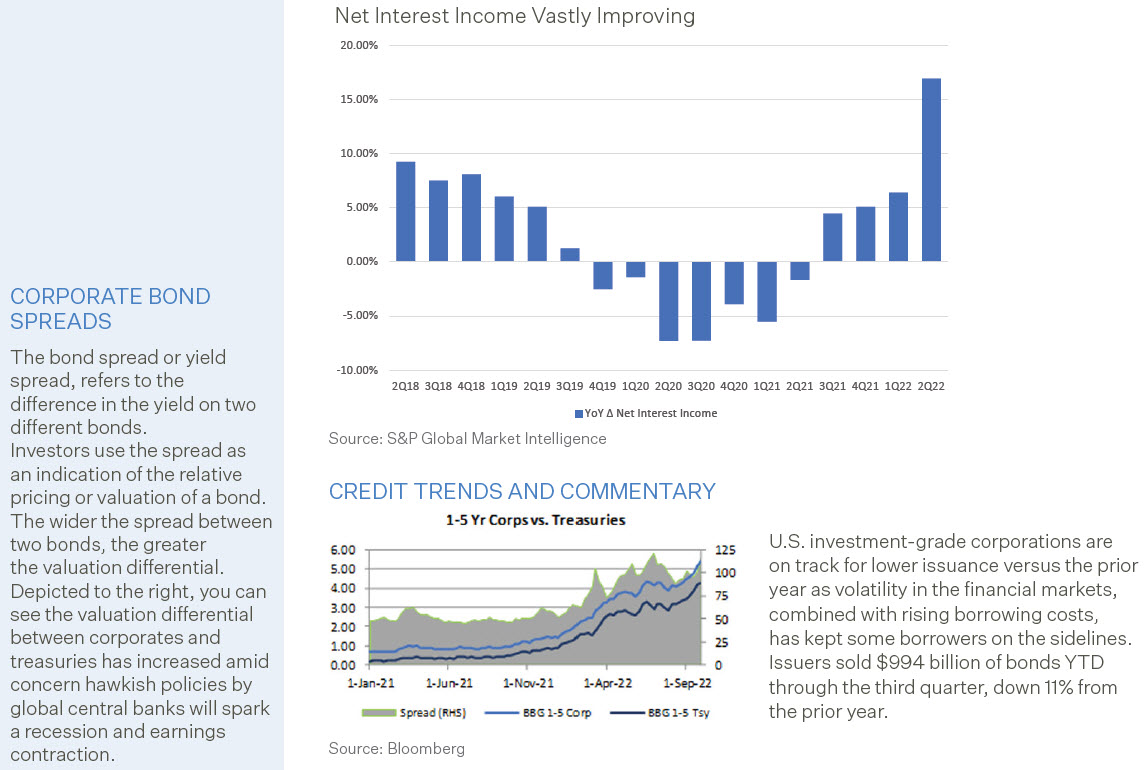

As the Federal Reserve has moved short-term rates higher, the rate banks offer on their certificates of deposits has lagged significantly. Across the industry, the average rate for one-year CDs increased by 0.36% to 0.62% from September 2021 to September 2022. Large banks (>$250bn) led the way with an increase of 0.77% for one-year CDs over that period. With the fed funds rate increasing by 2.25% over the same period, that equates to a deposit beta, or the proportion of the change in rates that banks pass on to clients, of 16%. According to S&P Global Market Intelligence, the banking sector had a deposit beta of 57% in 2018 when the fed funds rate increased 0.76%. After shrinking their CD balances nearly 39% between 2019 and the first quarter of 2022, institutions grew CDs balances 6% in the second quarter, suggesting that banks want to lock in funding before deposit costs rise more materially. Even though deposit costs may increase, banks should still be able to report higher interest margins as the industry’s aggregate net interest margin rose to 2.73% in the second quarter, up 24 basis points from the prior quarter. Annualized growth in net interest income was the highest in five years at 17%.

Banking Trends

FDIC-insured institutions reported second quarter 2022 net income of $64.4 billion, a decrease of $6.0 billion (8.5%) compared with the prior year period. An increased amount in provision expenses (up $21.9 billion) drove the year over year decline in net income. A majority (51.8%) of all banks reported year-over-year reduction in quarterly net income.

Quarterly provisions for credit losses increased to $11.1 billion, up significantly from negative $10.8 billion in the year-ago quarter. Despite the aggregate increase in provisions, only one-third of all institutions (33.0%) reported higher provisions compared with the year-ago quarter. Noncurrent balances for total loans and leases declined $7.2 billion (7.6%) from first quarter 2022. The average noncurrent rate was 0.75% during the second quarter, down nine basis points from the prior quarter. The net charge-off rate declined by seven basis points from a year ago to 0.23%.

Total assets declined by $255.1 billion (1.1%) from the previous quarter. Total loans and leases increased $4149 billion (3.7%) from first quarter 2022, while securities declined $111.9 billion (1.8%). Banks distributed 45.1% of second quarter earnings as dividends, which were just below the proportion reported in first quarter 2022. The number of institutions on the FDIC’s “Problem List” remained unchanged from first quarter at 40, the lowest level since Quarterly Banking Profile (QBP) data collection began in 1984. Total assets of problem banks decreased to $170.4 billion. During the quarter, 6 new charters were added, 28 institutions were absorbed by mergers, and zero institutions failed.

Source: FDIC: Quarterly Banking Profile

The PMA Report

PMA Credit Research Process

The PMA Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 4: Assign PMA Rating and Deposit Limits

Risk management procedures include deposit restrictions and collateral requirements. PMA’s Credit Committee, which includes members of PMA’s senior management, meets formally on a quarterly basis, to review credit reports and recommendations for PMA Ratings and deposit limits. PMA actively manages and adjusts bank’s ratings and deposit limits throughout the life of the deposit.

When deposits exceed FDIC or other federal deposit insurance limits, collateral must be put into place, which is monitored and reported to clients every month. Collateral programs offered by PMA include letters of credit issued by a Federal Home Loan Bank and marketable securities pledged to third party custodians.