Recent News

Banks Utilize Cautious Investment Approach

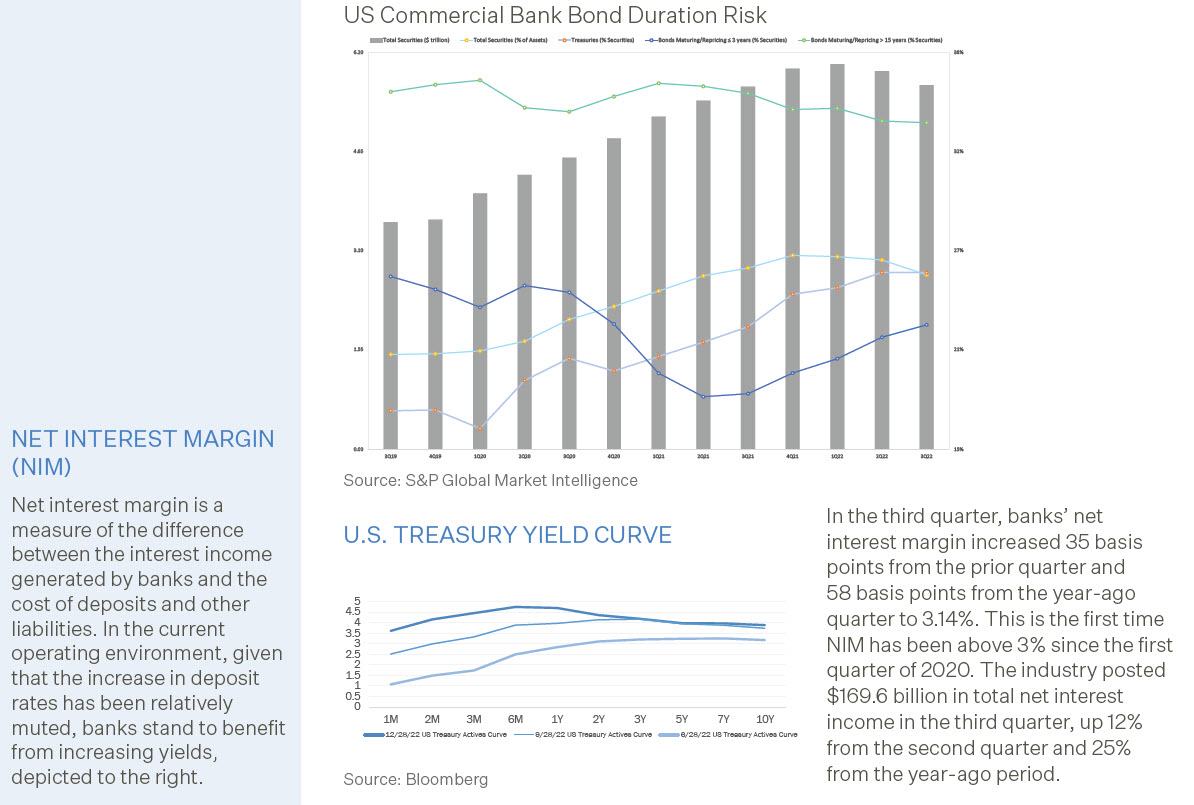

U.S. commercial banks were hesitant to deploy their cash into securities in the third quarter as securities fell 3.7% from the prior quarter, declining to 25% of assets from 26% the prior quarter, according to S&P Global Market Intelligence. As unrealized losses have grown in banks’ securities portfolios with average yields on the 2-year, 3-year and 5-year Treasuries up over 185bps or more since the tightening cycle began in March, institutions have recently faced deposit outflows, making them even more cautious to put new cash to work in the bond market. Bank deposits in the third quarter were down 1.1% from the prior quarter and have declined for three straight quarters as the Fed continues to increase interest rates. Even though yields are higher, banks allocated less cash toward the long end of the curve in the third quarter since those securities may face additional pressure if rates continue to rise. Bonds expected to reprice or mature in more than 15 years comprised 33.9% of bank-held securities in the third quarter from 34% in the prior quarter and 35.6% in the year-ago period, while bonds expected to reprice or mature in three years or less comprised 22.2% of bank-held securities, up from 18.2% the prior year.

Banking Trends

FDIC-insured institutions reported third quarter 2022 net income of $71.7 billion, an increase of $7.3 billion (11.3%) compared with the prior quarter. An increase in net interest income more than offset increases in provisions for credit losses and noninterest expense. Nearly three quarters of all banks (73.3%) reported increases in net income from the prior quarter. At the same time, the share of institutions reporting quarterly losses fell to 3.5% in third quarter 2022, the lowest level in the history of the Quarterly Banking Profile (QBP).

Quarterly provisions for credit losses increased to $14.6 billion, up from $11.1 billion in the prior quarter and negative $5.2 billion in the year-ago quarter. Despite the increase in provisions, the average noncurrent rate was 0.72% during the third quarter, down three basis points from the prior quarter. The noncurrent rate for total loans is the lowest level since second quarter 2006. The net charge-off rate increased by seven basis points from a year ago to 0.26%.

Total assets decreased by $86.8 billion (0.4%) from the previous quarter. Total loans and leases increased $229.7 billion (2.0%) from second quarter 2022 and $1.1 trillion (9.9%) annually. Banks distributed 52.3% of third quarter earnings as dividends, up from 45.1% in second quarter 2022. The number of institutions on the FDIC’s “Problem List” increased by two from second quarter to 42. Total assets of problem banks decreased to $163.8 billion. During the quarter, three new charters were added, 26 institutions were absorbed by mergers, and zero institutions failed.

Source: FDIC: Quarterly Banking Profile

The PMA Report

PMA Credit Research Process

The PMA Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 1: Gather Bank Data

The process begins with gathering bank, industry and economic data from an extensive list of sources. Bank financial data is received from a variety of regulatory filings. Industry tools like Bloomberg and S&P Global Market Intelligence are utilized in obtaining data and other relevant information. Additionally, a number of publications focusing on the banking industry and local and national economy are monitored daily.