Credit Quarterly Recent News

Mortgage Rates Jump to Seven-Year High

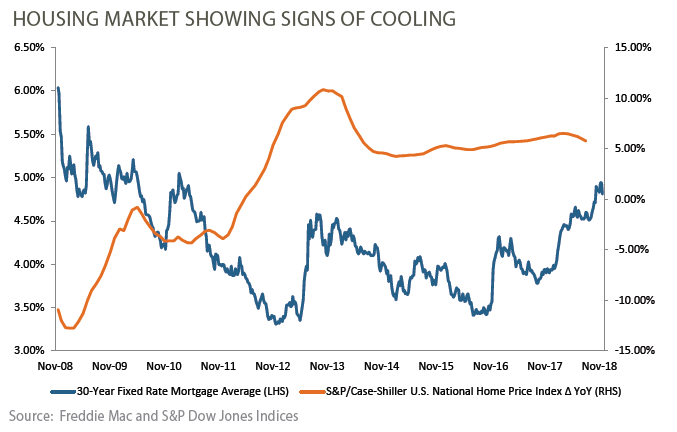

In November, 30-year fixed mortgage rates hit their highest level in more than seven years at nearly 5%, up almost 1% over the past year. For a house with a $250,000 mortgage, a 5% mortgage rate adds approximately $150 to the monthly payments compared with a rate of 4%, according to LendingTree Inc. A 5% mortgage rate isn’t high by historic standards as rates hovered between 5% – 7% during much of the decade before the financial crisis, but a return to more normal lending rates has slowed the residential real estate market. Existing home sales fell in August from a year earlier, the sixth straight month of declines. The S&P CoreLogic Case-Shiller National Home Price Index, which measures average home prices in major metropolitan areas across the United States, rose 5.8% in August, down from a 6% year-over-year increase in July and a 6.3% annual increase in January. August marked the fifth straight month of decelerating gains. Despite the pullback in the housing market, there are no signs of weakening bank asset quality as non-performing 1-4 Family Real Estate loans at U.S. banks remained low at 1.05% in the third quarter of 2018, down from 1.31% the prior year.

Credit Quarterly Banking Trends

4th Quarter 2018 Highlights

FDIC-insured institutions reported third quarter 2018 net income of $62 billion, an increase of $14 billion (29.3%) compared with the prior year period. The increase was mainly driven by lower income taxes enacted from the new tax law and higher net operating revenue. Excluding the tax effects, estimated quarterly net income would have been $54.6 billion, an increase of 13.9% from a year ago. More than 83% of banks reported year-over-year increases in net interest income. Average net interest margin increased to 3.45% from 3.30% in third quarter 2017. Only 3.5% of institutions were unprofitable during the quarter.

Provisions for loan losses in the third quarter totaled $11.9 billion, a decline of $1.7 billion from a year ago. Almost one third of institutions reported lower loan-loss provisions than in third quarter 2017. Noncurrent balances for total loans and leases decreased $3.6 billion (3.4%) during the third quarter compared to the prior quarter. Average net charge-off rate declined 1 basis point from a year earlier to 0.48%.

Total assets increased by $140 billion (0.8%) from the previous quarter. Balances in all major loan categories experienced growth. Total equity capital increased by $13.5 billion from the previous quarter. Declared dividends in the third quarter totaled $43.8 billion, an increase of 22% from the same period last year. The number of institutions on the FDIC’s “Problem List” declined from 82 to 71 in the third quarter, the lowest number of problem banks since third quarter 2007. During the quarter, one new charter was added, 60 institutions were absorbed by mergers, and zero institutions failed.

Source: FDIC: Quarterly Banking Profile

Prudent Man Process

The Prudent Man Analysis

The Prudent Man Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 4: Ongoing Risk Management

Risk management procedures include deposit restrictions and collateral requirements. PMA’s Credit Committee, which includes members of PMA’s senior management, meets formally on a quarterly basis, to review credit reports and recommendations for PMA Ratings and deposit limits. PMA actively manages and adjusts bank’s ratings and deposit limits throughout the life of the deposit.

When deposits exceed FDIC or other federal deposit insurance limits, collateral must be put into place, which is monitored and reported to clients every month. Collateral programs offered by PMA include letters of credit issued by a Federal Home Loan Bank and marketable securities pledged to third party custodians.