Recent News

U.S. Bank Margins Rebound

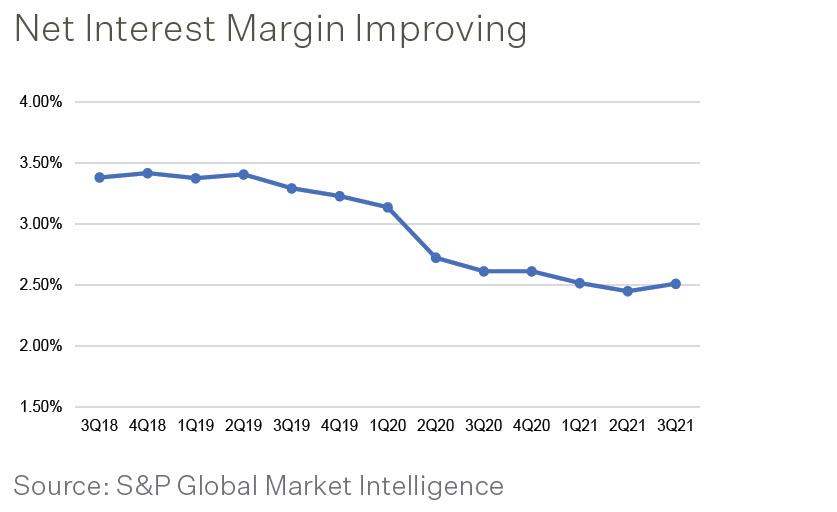

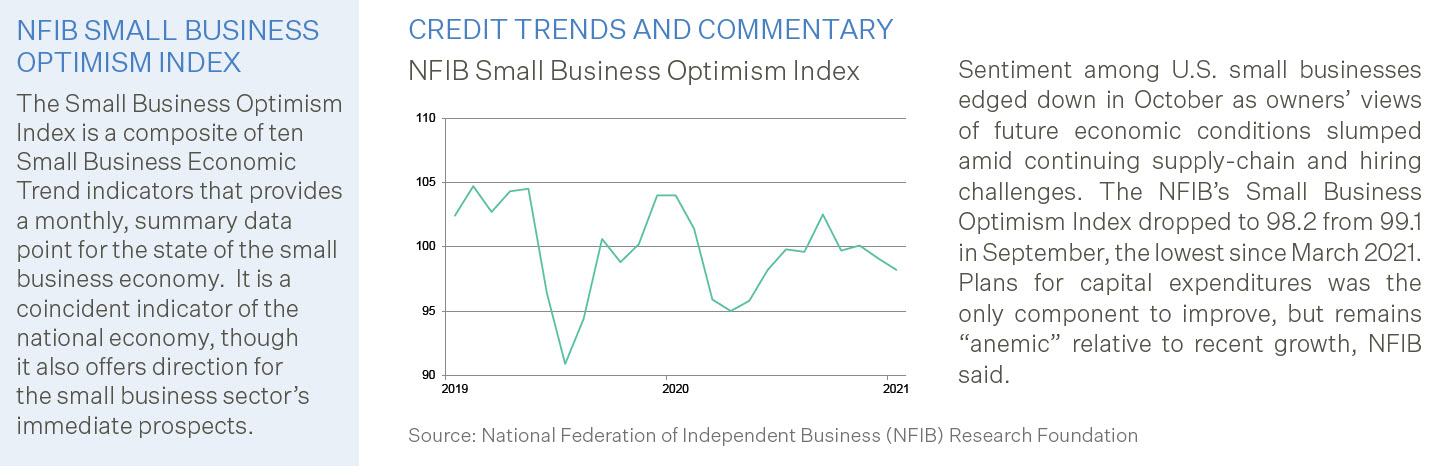

After declining for ten straight quarters, U.S. bank margins rebounded in the third quarter. The banking industry’s aggregate net interest margin rose to 2.51% in the third quarter, up six basis points from the prior quarter. The industry’s loan yield rose to 4.34% in the third quarter from 4.25% in the second quarter but was down from 4.39% a year ago. Paycheck Protection Program (PPP) forgiveness bolstered yields on commercial and industrial credits, which jumped to 4.19% in the third quarter, up 29 basis points from the linked quarter and 71 basis points from a year earlier. As PPP loans are forgiven, may lenders are able to recognize revenue from origination fees. Yields on other asset classes showed little change. Despite the sequential increase, the industry’s net interest margin is down ten basis points from the prior year and 63 basis points below pre-pandemic levels. Margins have tumbled due to the low interest rate environment and excess liquidity on bank balance sheets as emergency relief measures enacted during the pandemic sparked unprecedented deposit growth. Loan growth remains weak as borrowers continue to prioritize liquidity. Consumer savings expanded during the pandemic, partly due to government stimulus and expanded unemployment benefits. Expanded unemployment benefits began to wane in many states in May and ultimately expired in September. In the third quarter, deposits increased 12% from the prior year, while loans rose just 0.1%. Since 2019, deposits have grown almost 32%, while loans have increased approximately 4%.

Banking Trends

FDIC-insured institutions reported third quarter 2021 net income of $69.5 billion, an increase of $18.4 billion (35.9%) compared with the prior year period. The increase was primarily due to a $19.7 billion decline (136.2%) in provision expense (provisions). Net interest income increased over the same period as the decline in interest expense outpaced the decline in interest income. Two-thirds (66.5%) of all banks reported year-over-year increases in quarterly net income, and the percentage of profitable institutions in the third quarter increased slightly year-over-year to 95.9%.

Quarterly provisions for credit losses were negative $5.2 billion. More than half of all institutions (58%) reported lower provisions compared with the year-ago quarter. Noncurrent balances for total loans and leases decreased $7 billion (6.3%) from second quarter 2021. The average noncurrent rate was 0.94% during the third quarter, down seven basis points from the prior quarter. The net charge-off rate declined by 27 basis points from a year ago to 0.19%, a record low.

Total assets rose by $462.6 billion (2%) from the previous quarter. Cash and balances due from depository institutions rose by $126.8 billion (3.6%), while securities holdings rose by $225 billion (3.9%). Total loans and leases increased $62.7 billion (0.6%) from second quarter 2021, led by 1-4 family residential mortgages and consumer loans. Total equity capital increased by $33.8 billion (1.5%) from the previous quarter. The number of institutions on the FDIC’s “Problem List” declined by five from the second quarter to 46, the lowest level on record in the Quarterly Banking Profile (QBP). During the quarter, three new charters were added, 39 institutions were absorbed by mergers, and zero institutions failed.

Source: FDIC: Quarterly Banking Profile

The PMA Report

PMA Credit Research Process

The PMA Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 2: Data Analysis: Qualitative

Bank credit analysis requires insight into a bank’s balance sheet, management and regulatory standing. The composition and quality of assets and liabilities are reviewed, as any balance sheet concentrations can provide insight into a bank’s risk profile. To determine regulatory standing, analysts search for bank enforcement actions on the FDIC, OCC and Federal Reserve Bank websites. Additionally, if the company is publicly traded, a review of public Securities and Exchange Commission documents is completed.

Qualitative analysis also includes an assessment of industry performance and economic conditions. Banking industry developments are monitored daily and analysts conduct sector analysis within the banking industry to better understand business segments such as commercial real estate, residential mortgages and credit card lending. Economic trends that may affect bank performance are also monitored.