Credit Quarterly Recent News

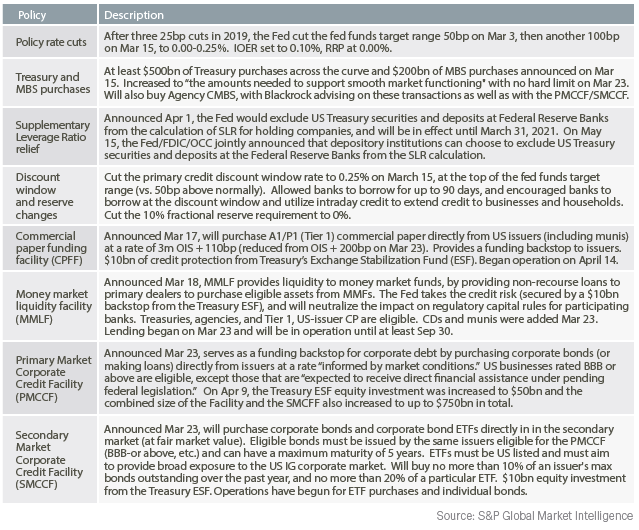

The Fed’s Alphabet Soup

In light of the coronavirus and ensuing market volatility, the Fed has been very active with a host of policy changes and funding programs to ensure adequate liquidity and funding to the markets. Above is a summary of relevant changes.

Credit Quarterly Banking Trends

1st Quarter 2020 Highlights

FDIC-insured institutions reported first quarter 2020 net income of $18.5 billion, a decrease of $42.2 billion (69.6%) compared with the prior year period. The annual decline is a reflection of deteriorating economic activity, which resulted in an increase in provision expenses and goodwill impairment charges. Slightly more than half (55.9%) of all banks reported year-over-year declines in net income, and the percentage of unprofitable banks in the first quarter increased from a year ago to 7.3%. Average net interest margin (NIM) was down 29 basis points from a year ago to 3.13%, as the decline in average earning asset yields outpaced the decline in average funding costs.

Provisions for credit losses in the fourth quarter totaled $52.7 billion, an increase of $38.8 billion from a year ago. Almost half (49.9%) of all banks reported year-over-year increases in loan-loss provisions. Noncurrent balances for total loans and leases increased $7 billion (7.30%) during the first quarter compared to the prior quarter, the highest quarterly dollar increase since first quarter 2010. The average net charge-off rate increased five basis points from a year earlier to 0.55%, driven by increases in commercial and industrial and credit card loans.

Total assets rose by $1.6 trillion (8.6%) from the previous quarter. Almost all of the major loan categories registered quarterly increases, except for the credit card balances which declined by $68.6 billion (7.3%). Total equity capital increased by $4.2 billion from the previous quarter. Declared dividends in the first quarter totaled $32.7 billion, exceeding the quarterly net income of $18.5 billion, and resulting in a $14.2 billion reduction of retained earnings. The number of institutions on the FDIC’s “Problem List” increased from 51 to 54 in the first quarter. During the quarter, two new charters were added, 57 institutions were absorbed by mergers, and one institution failed.

Source: FDIC: Quarterly Banking Profile

The PMA Report

The PMA Credit Research Process

The PMA Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 2: Data Analysis – Qualitative

Bank credit analysis requires insight into a bank’s balance sheet, management and regulatory standing. The composition and quality of assets and liabilities are reviewed, as any balance sheet concentrations can provide insight into a bank’s risk profile. To determine regulatory standing, analysts search for bank enforcement actions on the FDIC, OCC and Federal Reserve Bank websites. Additionally, if the company is publicly traded, a review of public Securities and Exchange Commission documents is completed.

Qualitative analysis also includes an assessment of industry performance and economic conditions. Banking industry developments are monitored daily and analysts conduct sector analysis within the banking industry to better understand business segments such as commercial real estate, residential mortgages and credit card lending. Economic trends that may affect bank performance are also monitored.