Recent News

US Banks Set Net Income Record, More Steam Ahead?

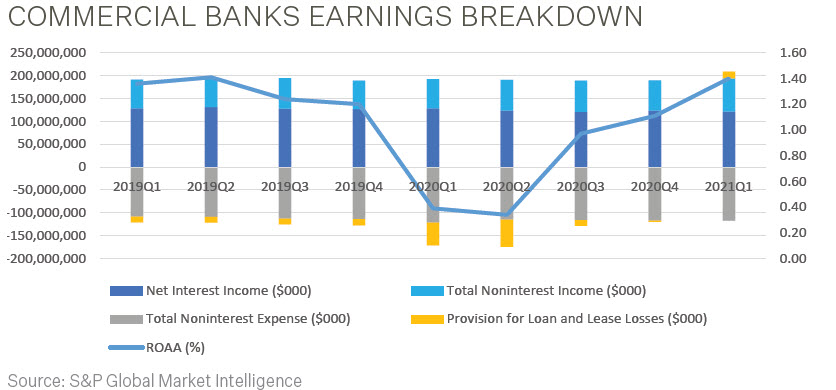

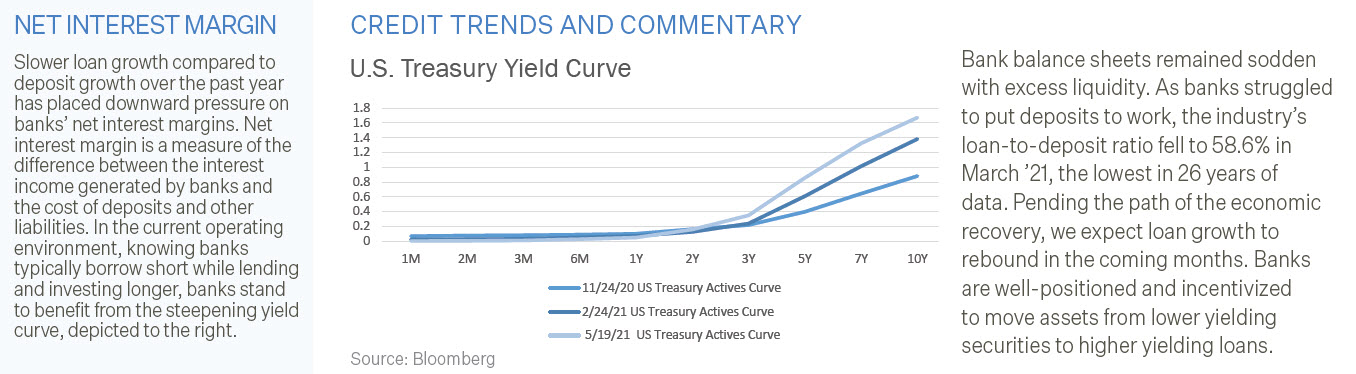

The US Banking industry set an all-time high in net income, which was 21% higher than the previous record set in the second quarter of 2019. Two transitory factors were largely at play during the quarter: negative provisioning (loan loss reserves being released, providing an earnings tailwind) and a widening discrepancy between loans and deposits, which has subsequently pressured Net Interest Margin (NIM). The first quarter of 2021 represents the only quarter with a negative provision during the last 30 years, highlighting the speed of the economic recovery. Excluding the negative provision however, profitability has not dramatically fluctuated during the last three years. Pre-provision revenue was $81.5 billion, which was 8% higher than the year-ago period but below the 13-quarter average. Also helping fuel profitability was balance sheet growth, as total assets climbed 11% from a year ago, and have grown 68.7% in the last 13 years to an all-time high. In addition to growth, balance sheet composition has changed significantly as well. A long-term trend in the industry is loan growth failing to keep pace with deposit growth. In the last year, deposits are up 17.0%, while loans have fallen 1.2%. As a result, the industry loan-to-deposit ratio declined to 58.6% on March 31, 2021 from 69.5% a year ago and 93.0% in 2008. A greater reliance on lower-yielding assets (securities and cash and equivalents) due to tepid loan growth, is causing margin compression and hurting profitability despite growing balance sheets. Positively, we anticipate loan growth to pick up as we emerge from the pandemic in the coming months. Loan-to-Deposit ratios should return to more historical levels and provide greater yields for bank profitability in the quarters and years ahead.

Banking Trends

For the 4,978 FDIC-insured commercial banks and savings institutions, first quarter 2021 net income totaled $76.8 billion, an increase of $17.3 billion (29.1%) from the linked quarter and up $58.3 billion (315.3%) from a year ago. The quarterly increase in net income was primarily attributable to a provision expense of $-14.5 billion, declining $17.7 billion from fourth quarter 2020. Three-fourths (74.8%) of all banks reported year-over-year increases in quarterly net income, and the percentage of unprofitable banks in the first quarter dropped from 7.4% a year ago to 3.9%. Average net interest margin (NIM) was down 57 basis points from a year ago to 2.56%, the lowest level on record in the Quarterly Banking Profile (QBP).

Quarterly provisions for credit losses totaled $-14.5 billion, the lowest level on record. Less than one-fourth of all institutions (24.5 percent) reported higher provisions compared with the year-ago quarter. Noncurrent balances for total loans and leases decreased $5.9 billion (4.6%) year-over-year. The net charge-off rate declined by 20 basis points from a year ago to 0.34%. The annual decrease in net charge-offs was attributable to a $3.3 billion (36.4%) reduction in credit card net charge-offs.

Total assets rose by $680.9 billion (3.1%) from the previous quarter. Cash and balances due from depository institutions rose by $440.1 billion (13.8%). Securities holdings rose by a record-high quarterly dollar increase of $366.9 billion (7.2%). Total equity capital increased by $26.1 billion (1.2%) from the previous quarter. Quarterly net income in the fourth quarter totaled $76.8 billion, exceeding declared dividends of $23.9 billion, contributing $52.9 billion to retained earnings. The number of institutions on the FDIC’s “Problem List” declined by one from the previous quarter to 55. During the quarter, 3 new charters were added, 25 institutions were absorbed by mergers, and no banks failed

Source: FDIC: Quarterly Banking Profile

The PMA Report

The PMA Credit Research Process

The PMA Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 2: Data Analysis – Qualitative

Bank credit analysis requires insight into a bank’s balance sheet, management and regulatory standing. The composition and quality of assets and liabilities are reviewed, as any balance sheet concentrations can provide insight into a bank’s risk profile. To determine regulatory standing, analysts search for bank enforcement actions on the FDIC, OCC and Federal Reserve Bank websites. Additionally, if the company is publicly traded, a review of public Securities and Exchange Commission documents is completed.

Qualitative analysis also includes an assessment of industry performance and economic conditions. Banking industry developments are monitored daily and analysts conduct sector analysis within the banking industry to better understand business segments such as commercial real estate, residential mortgages and credit card lending. Economic trends that may affect bank performance are also monitored.