Credit Quarterly Recent News

C&I Loans Fall to an 8-Month Low

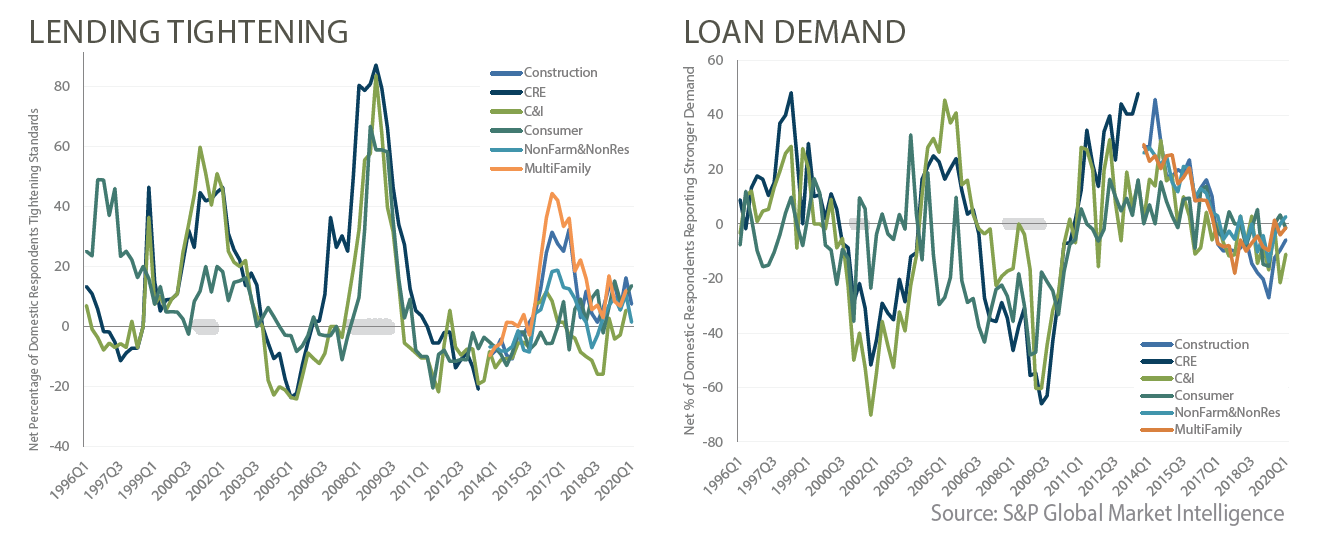

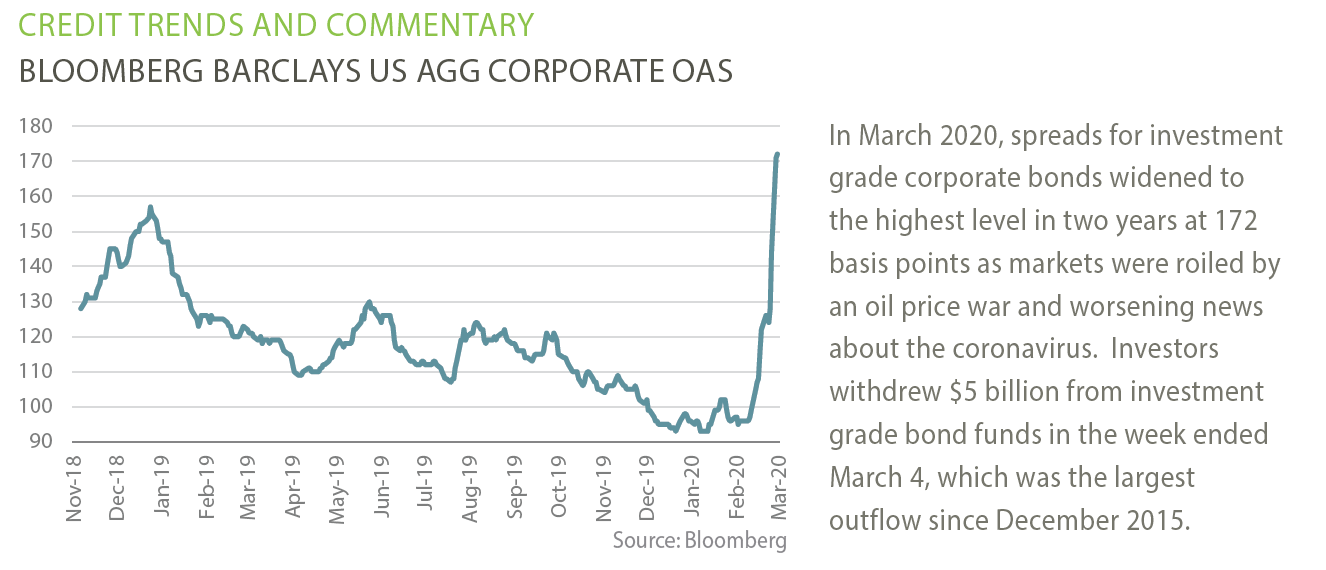

In PMA’s Winter 2020 Market Outlook, we summarized banking industry data conducted in 2019. Our goal was to identify bank data providing the strongest leading indicators of a recession. Our analysis showed that loan demand and lending tightening by banks were good indicators of a recession during the study period. We determined that neither of these factors were forecasting an imminent recession. More data has since been released, triggering us to reconsider whether a recession is nearing. Our research indicated that loan demand was the most telling metric in terms of longest time between change in trend and the start of each recession. Focusing on Commercial and Industrial loans (C&I), we saw three consecutive quarters of a clear reduction in loan demand prior to the 2001 Credit Recession. Additionally, C&I loans saw five consecutive quarters of declining loan demand prior to the Great Recession. In today’s landscape, C&I loans have seen loan demand slowly decrease for several years, which indicates a higher recession probability in upcoming quarters. While loan demand hasn’t fallen as deep or rapidly as observed before the two prior recessions, there is a clear trend of falling C&I loan demand. Tighter lending standards have also showed significant lead time before both of the previous recessions. C&I lending tightened 10 quarters prior to the 2001 Credit Recession and tightened two quarters in advance of the Great Recession. Banks have reported somewhat tighter lending conditions for C&I loans over the past 4 quarters. In recent news, C&I loans fell to an eight-month low at U.S. commercial banks in January. Irrespective of the recent coronavirus news which makes a recession much more likely, the probability for a recession has been growing based on our analysis of banking industry data.

Credit Quarterly Banking Trends

4th Quarter 2019 Highlights

FDIC-insured institutions reported fourth quarter 2019 net income of $55.2 billion, a decrease of $4.1 billion (6.9%) compared with the prior year period. The annual decline in quarterly net income was a result of lower net interest income and higher noninterest expenses. About half (45.6 percent) of all banks reported year-over-year declines in net income, and the percentage of unprofitable banks in the fourth quarter remained stable from a year ago at 7.2 percent. Average net interest margin (NIM) declined from 3.40 percent in 2018 to 3.36 percent in 2019, as average earning assets grew at a faster rate than net interest income.

Provisions for loan losses in the fourth quarter totaled $14.8 billion, an increase of $779 million from a year ago. However, only about 38 percent of all banks reported year-over-year increases in loan-loss provisions. Noncurrent balances for total loans and leases decreased $46.4 million (0.05%) during the fourth quarter compared to the prior quarter. The average net charge-off rate increased four basis points from a year earlier to 0.54%, driven by increases in commercial and industrial and credit card loans.

Total assets rose by $163.4 billion (0.9%) from the previous quarter. Almost all of the major loan categories registered quarterly increases, except for the C&I loan portfolio which registered the first quarterly decline since fourth quarter 2016. Total equity capital increased by $22 billion from the previous quarter. Declared dividends in the fourth quarter totaled $49.1 billion, a decrease of 1.4% from the same period last year. The number of institutions on the FDIC’s “Problem List” declined from 55 to 51 in the fourth quarter, the lowest number of problem banks since the fourth quarter of 2006. During the quarter, three new charters were added, 77 institutions were absorbed by mergers, and three institutions failed.

Source: FDIC: Quarterly Banking Profile

Prudent Man Process

The Prudent Man Analysis

The Prudent Man Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 1: Gather Bank Data

The process begins with gathering bank, industry and economic data from an extensive list of sources. Bank financial data is received from a variety of regulatory filings. Industry tools like Bloomberg and S&P Global Market Intelligence are utilized in obtaining data and other relevant information. Additionally, a number of publications focusing on the banking industry and local and national economy are monitored daily.