Recent News

Banks Shift Deposit Composition Amidst Cost-cutting Efforts

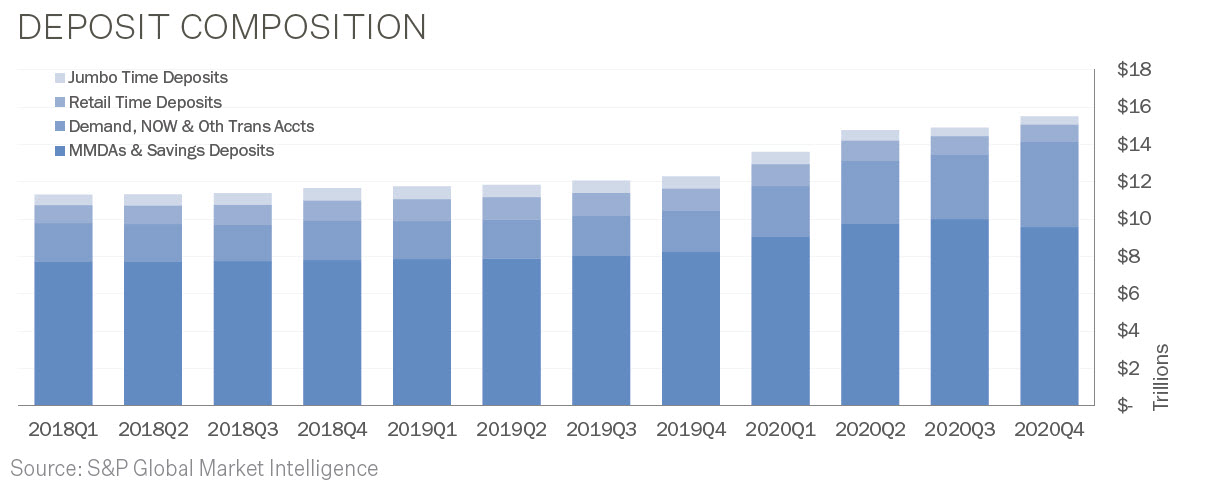

Deposits have continued to build up on bank balance sheets, prompting banks to adopt differing strategies including setting balance limits for some individual commercial clients in an effort to minimize excess funding amid soft loan demand. Total deposits across the industry in the U.S. grew 3.9% sequentially in the fourth quarter of 2020, according to data from S&P Global Market Intelligence. The increase was led by a 32.6% jump in transaction balances, typically banks’ lowest-cost funding base. Overall during the year, deposits surged 23.2% from the end of 2019, and transaction balances more than doubled. The bank analytics and advisory company, Novantas published a survey of 40 large commercial banks and found that 72% had taken steps to actively discourage commercial deposit growth, with many using “reverse tiering,” which involves lower interest rates for higher balances. According to Peter Gilchrist, executive vice president at Novantas, “It’s a basic balance sheet management issue. There’s nowhere to put [the excess] deposits. Including fees banks assess for deposit insurance, the surfeit of liquidity has led to slightly negative effective interest rates for some large clients.” Across the industry in the fourth quarter, funding costs ticked down even further from already near-zero levels with the cost of savings deposits hitting 11 basis points. Broadly, banks are intent on adding new commercial customers, focusing on clients that sign up for multiple services even as they work on “off-loading the excess deposits,” Gilchrist said.

Banking Trends

1st Quarter 2021 Highlights

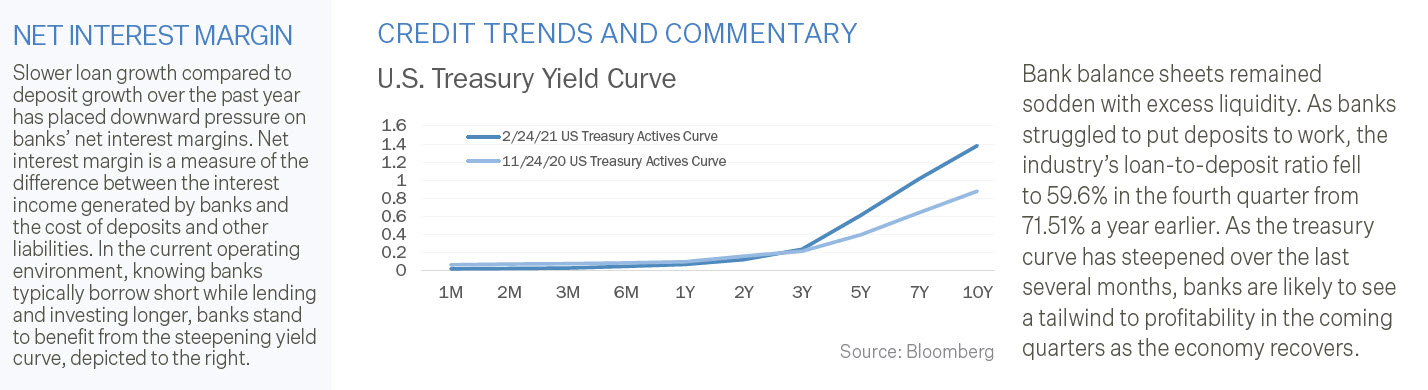

For the 5,001 FDIC-insured commercial banks and savings institutions, full-year 2020 net income totaled $147.9 billion, a decline of $84.9 billion (36.5%) from 2019. FDIC-insured institutions reported fourth quarter 2020 net income of $59.9 billion, up $5 billion (9.1%) from a year ago. The quarterly increase in net income was primarily attributable to an $11.4 billion (76.5%) decline in provision expenses between third and fourth quarter 2020. Slightly more than half (57.4%) of all banks reported year-over-year increases in quarterly net income, and the percentage of unprofitable banks in the fourth quarter remained stable from a year ago at 7.3%. Average net interest margin (NIM) was down 60 basis points from a year ago to 2.68%, as the decline in average earning asset yields outpaced the decline in average funding costs.

Quarterly provisions for credit losses totaled $3.5 billion, down nearly 77% from third quarter 2020. The decline in provisions for credit losses was not broad-based, as less than one-third (31.2%) of all banks reported year-over-year declines. Noncurrent balances for total loans and leases increased $1.5 billion (12.80%) year-over-year. The net charge-off rate declined by 13 basis points from a year ago to 0.41%. The annual decrease in net charge-offs was attributable to a $3.4 billion (39.7%) reduction in credit card net charge-offs.

Total assets rose by $664 billion (3.1%) from the previous quarter. Cash and balances due from depository institutions rose by $357 billion (12.6%). Securities holdings rose by a record-high quarterly dollar increase of $321.4 billion (6.7%). Total equity capital increased by $41.9 billion

(1.9%) from the previous quarter. Quarterly net income in the fourth quarter totaled $59.9 billion, exceeding declared dividends of $21.8 billion, contributing $38.1 billion to retained earnings. The number of institutions on the FDIC’s “Problem List” remains unchanged from the previous quarter at 56. During the quarter, 3 new charters were added, 31 institutions were absorbed by mergers, and 2 banks failed.

Source: FDIC Quarterly Banking Profile

The PMA Report

The PMA Credit Research Process

The PMA Process includes four steps which begin with gathering data and analyzing a bank’s credit quality and continues with ongoing risk management throughout the life of a deposit. The process helps public funds investors avoid repayment, reinvestment and reputation risk that may be associated with a bank failure.

Step 1: Gather Bank Data

The process begins with gathering bank, industry and economic data from an extensive list of sources. Bank financial data is received from a variety of regulatory filings. Industry tools like Bloomberg and S&P Global Market Intelligence are utilized in obtaining data and other relevant information. Additionally, a number of publications focusing on the banking industry and local and national economy are monitored daily.