Investment Advisory Services Featured Economic Indicator

FED Leading Interest Rates Higher

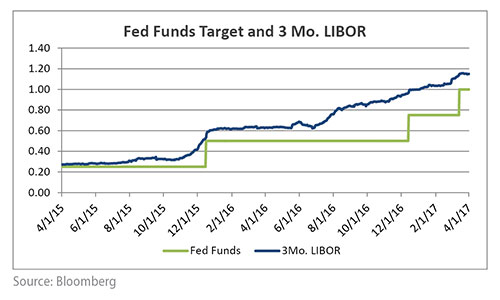

The Federal Reserve has increased interest rates three times since December 2015 by a total of 75 basis points including two hikes since December 2016. Current and projected employment and inflation data, as well as the Fed’s own projections, suggest that the Fed will continue to raise rates in the coming months and years. Rising rates represent an opportunity for short-term investors. Money market products such as commercial paper and some certificates of deposit price off of LIBOR. 3-Month LIBOR has increased about 80 basis points since the Fall of 2015 contributing to higher yields earned by investors in these products.

Source: Wall Street Journal, www.census.gov

Investment Advisory Services Recent news

FED’s Preferred Inflation Measure

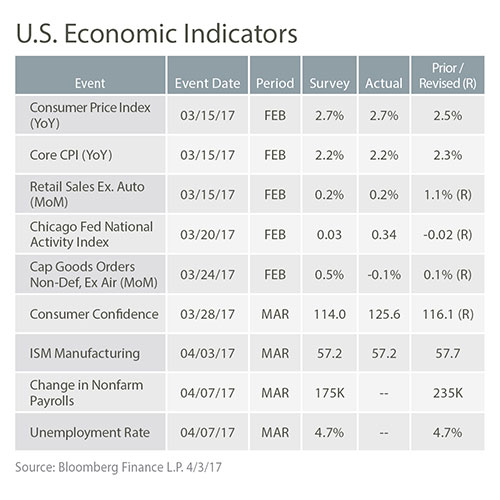

The Fed’s preferred measure of inflation continues to increase and is approaching the Fed’s target level of 2%. This inflation measure is the Core Personal Consumption Expenditures (PCE) price index. Compared to CPI, the weights for PCE are based on a more comprehensive measure of expenditures according to the Federal Reserve. Rising inflation signals that excess capacity and high unemployment may finally be abating. Along with employment, inflation is a key data point analyzed by the Fed as policy makers determine how much and how quickly to raise interest rates.

Source: Wall Street Journal, Bloomberg