Investment Advisory Services Featured Market Data

Market Volatility Increased In March

Trade-war fears, technology company weakness, White House turnover and action by the Federal Reserve all contributed to higher market volatility in March. For the month, the S&P 500 index was lower by over 5.5% and yields on the 10-year US Treasury bond were 13 basis points lower. The largest daily declines in yields on the 10-year Treasury were on March 1 (President Trump announced tariffs on steel and aluminum), March 22 (tariffs on Chinese imports announced), and March 27 (large-cap technology shares selloff). A somewhat more hawkish Fed also contributed to lower long-term Treasury yields and lower stock prices.

Source: Wall Street Journal, Bloomberg

Investment Advisory Services Recent News

FED Projects More Rate Hikes

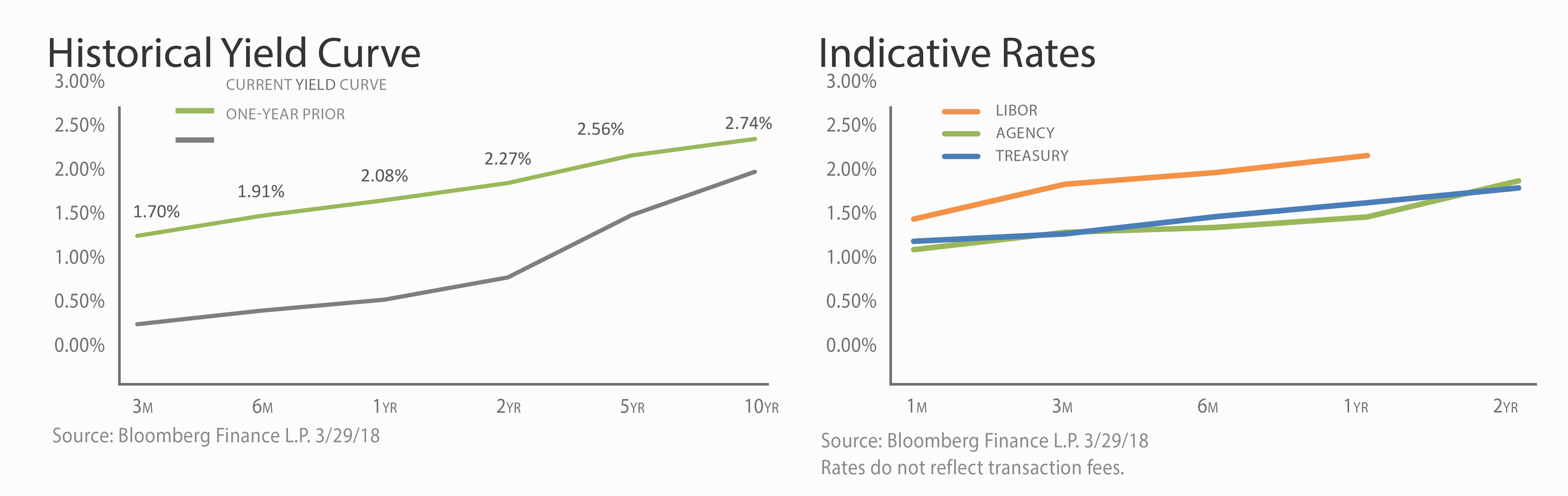

During their March meeting, Federal Reserve officials signaled they could pick up the pace of interest rate hikes. The Fed voted unanimously to raise its benchmark federal funds rate by a quarter-percentage point to a range of 1.50-1.75%. Fed projections communicated through the dot plots show Fed officials expected to lift rates another two times in 2018 and 3 times in 2019. However, compared to the prior release in December, more Fed officials expect a total of four rate hikes this year. Fed forecasts also show officials project faster economic growth, higher inflation and lower unemployment in coming years.

Source: Wall Street Journal