Investment Advisory Services Featured Market Data

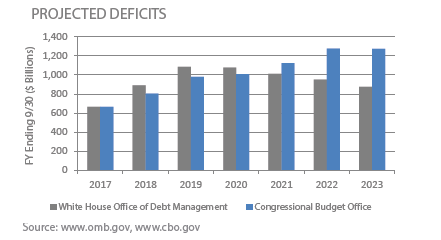

U.S. Deficits Fueling Increased Debt Issuance

Additional tax revenue from rising GDP in 2018 has failed to offset tax cuts and higher spending, resulting in wider deficits. To finance the growing deficits, the Treasury is boosting sales of Treasury bills, notes and bonds. Many analysts and investors forecast that these developments will lead to higher borrowing costs for the U.S. government. The White House’s Office of Debt Management and the Congressional Budget Office (CBO) both anticipate growing deficits through 2019. The CBO forecasts a continued upper trend through at least 2028 while the White House predicts that growing GDP will reverse the trend beginning in 2020. However, few economists believe the economy will be able to attain the President’s goal of sustained 3% growth.

Source: Wall Street Journal, Bloomberg

Investment Advisory Services Recent News

Strong Second Quarter GDP Growth

Strong second quarter economic growth was driven by solid consumer spending, business investment, exports and government spending. GDP grew at a 4.1% annualized rate in the second quarter. Most believe this high rate of growth, the strongest growth since the third quarter of 2014, is not sustainable. Consumer spending, critical to the US economy, grew 4% in the second quarter following weak 0.5% growth in the first quarter. Business spending also remained strong at 7.3% in the second quarter. The main soft spot was housing, which detracted from growth for the second straight quarter and could reflect higher mortgage rates and tax code changes.

Source: Wall Street Journal, www.bea.gov