Featured Market Data

Stimulus Spurs Economic Growth

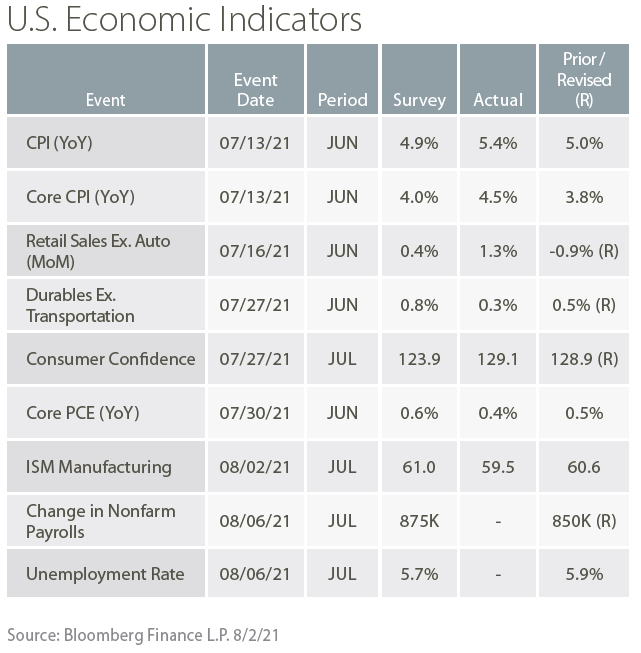

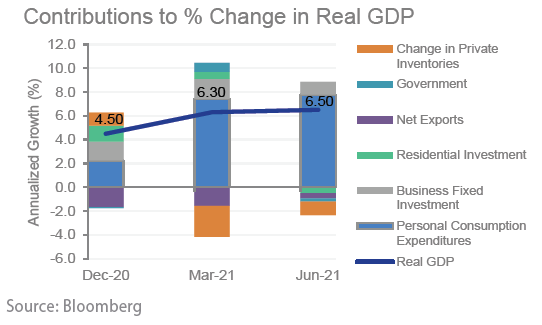

The US economy grew at an annualized real rate of 6.5% in the second quarter. While strong, results were below expectations of 8.4%. Personal consumption of 11.8% led GDP growth despite a decline in direct economic impact payments to households. Other programs including loans and grants to businesses increased in the second quarter. The increase in personal consumption reflected increases in services and a smaller increase in goods. Food services and accommodations led services growth. Business investment slowed, but remained positive in the second quarter while detractors to GDP growth included inventory, residential fixed investment and federal government spending. Net exports also detracted from growth.

Source: Wall Street Journal, www.bea.gov

Recent News

Volatility, Stocks and Bonds Higher

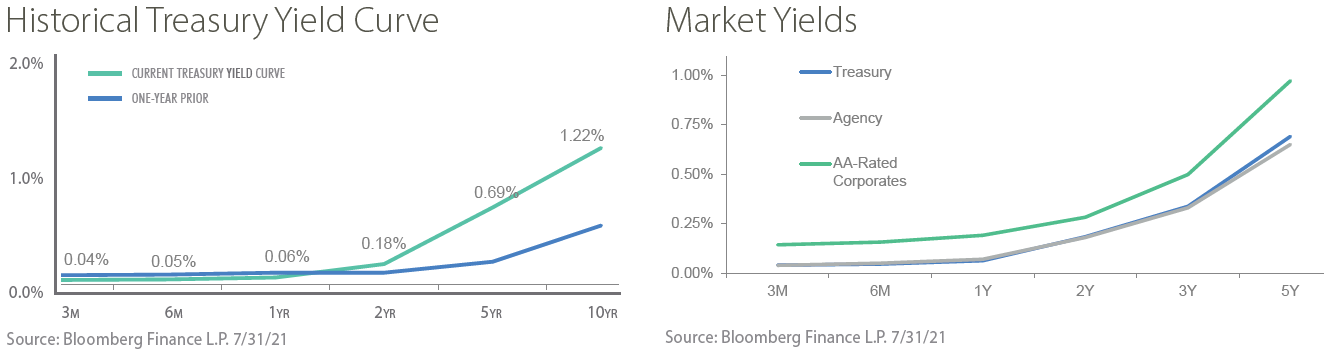

The S&P 500 closed July with gains despite increased focus on risks including the spread of Covid-19 variants and concerns about high valuations for growth stocks. Markets also contended with higher than expected inflation readings and weakness in some manufacturing gauges for the month. Growth stocks outperformed value and helped boost the S&P 500 index 2.27% for the month. The market is also struggling to price in expectations for when the Federal Reserve will dial back monetary policy support. Volatility was higher in stock and bond markets in July as Treasury yields rallied 25 basis points to 1.22%.

Source: Wall Street Journal, Bloomberg