Featured Market Data

Soft-ish Landing?

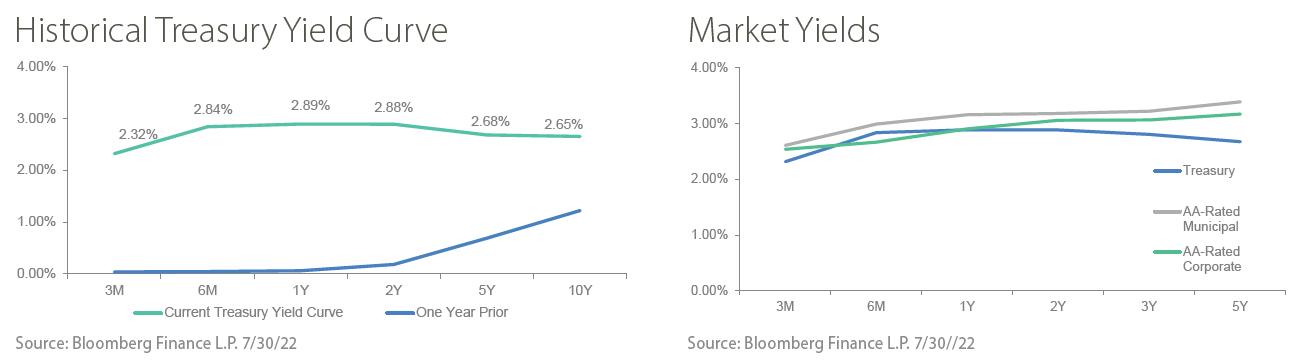

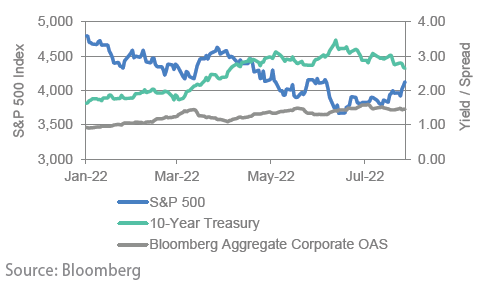

Markets turned generally more optimistic in July as the S&P 500 reported its strongest monthly returns since 2020, and growth meaningfully outperformed value. In bond markets, credit spreads declined for investment grade companies. The lower option adjusted spread (OAS) shows investors saw less credit risk for investment grade companies in July. Treasury returns were also positive in July as longer term yields, including the 10-year US Treasury, declined for the month. While the decline in Treasury yields generally portrays growth concerns, strong stock market returns and lower spreads reflect the large amount of downside that was already priced into markets.

Source: Wall Street Journal

Recent News

Federal Reserve and GDP

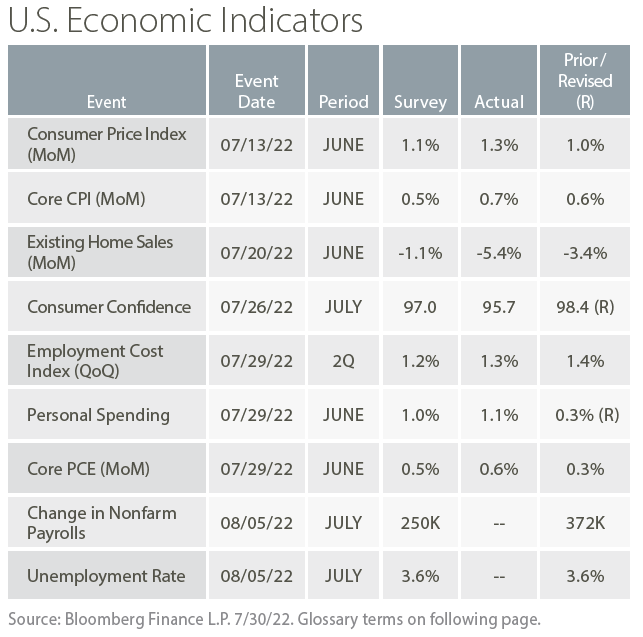

The final week of July included another 75 basis point rate hike by the Federal Reserve and the second consecutive quarterly decline in GDP. The Fed Funds rate is now at 2.25-2.5%, and has increased as much in 2022 as in the previous three years of hikes from 2015-2018. In a press conference following the Federal Open Market Committee meeting, Fed Chair Jerome Powell continued to emphasize the need to slow growth to help reduce inflation. The following day, the Bureau of Economic Analysis announced a 0.9% decrease in U.S. GDP. The report showed slower consumer growth and negative growth for businesses and governments. Imports also slowed compared to robust first quarter growth. The GDP report may be just what the Fed was looking for as it seeks to slow growth while avoiding a deep recession.

Source: Wall Street Journal