Investment Advisory Services Featured Economic Indicator

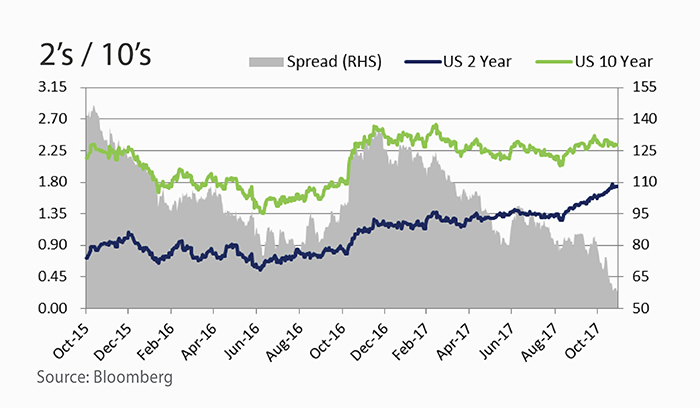

Bear Flattening Trend Continues

Short-term interest rates have steadily risen in 2017 while yields on the longer 10-year U.S. Treasury bond have remained relatively flat. Growth in 2-year Treasuries reflects accelerating growth in the domestic economy and expectations of further rate hikes by the Federal Reserve. The market’s tame inflation outlook is partly responsible for steady long-term rates. A flattening yield curve is characterized by a lower spread between short-term and long-term rates. The current trend is called a bear flattener because higher short-term rates push bond prices lower.

Source: Bloomberg

Investment Advisory Services Recent News

Initial Thoughts On Tax Reform

Early on Saturday, December 2nd, the Senate passed sweeping revisions to the U.S. tax code that would lower the corporate rate, reshape international business tax rules and temporarily lower individual taxes. The details of a final plan remain uncertain because the Senate bill still needs to be reconciled with the House bill passed in November. Nonetheless, lower corporate taxes would boost earnings. In general, smaller domestic-focused companies should benefit most, while firms with a large share of profits coming from outside the U.S. may not benefit as much. Reducing the corporate tax rate to 20% would put the rate on par with other large economies. Despite possible simulative effects, the Joint Committee on Taxation estimated that the tax cuts would increase deficits by $1 trillion over a decade.

Source: Wall Street Journal, Bloomberg