Featured Market Data

Stocks Down as Volatility Rose

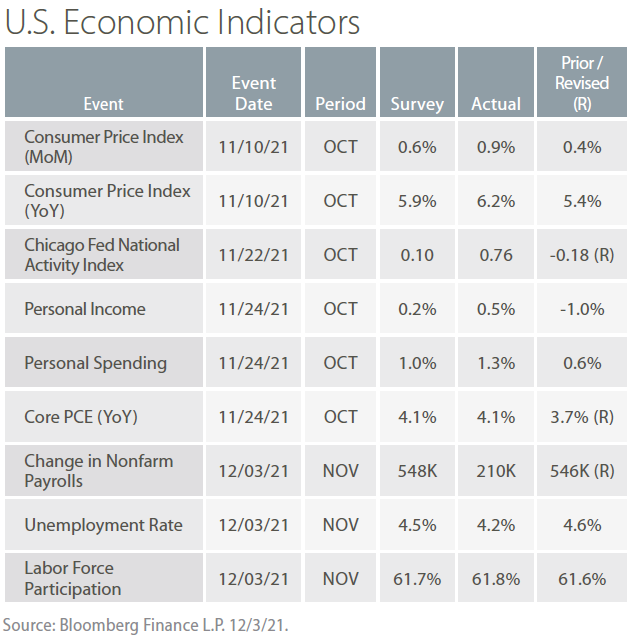

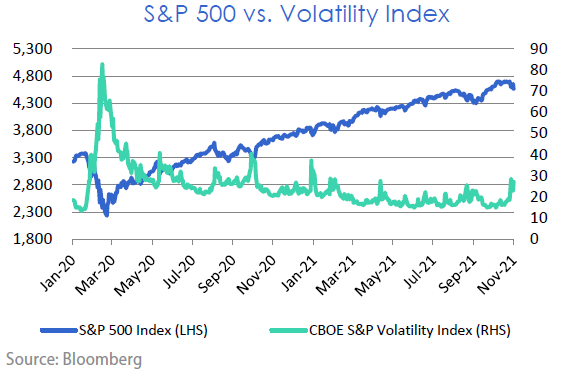

Volatility trended up during November even as equity markets generally climbed most of the month. The CBOE Volatility Index (VIX), a measure of expected stock market volatility surged to 27. Inflation and supply chain concerns weighed on investors, contributing to volatility. Positive market forces included progress on fiscal stimulus, third quarter corporate earnings strength and mostly positive economic data. The market turned sharply negative in the final days of the month as the new Omicron variant and hawkish comments from the Fed Chair Powell roiled financial markets. Equities finished lower in November with the S&P 500 index down -0.70% and the FTSE Global Ex. US index off -4.50%.

Source: Financial Times

Recent News

Powell Says Faster Taper Possible

In Congressional testimony on November 30, Fed Chair Jay Powell said the Fed would discuss a faster tapering of balance sheet growth at its December meeting. This followed remarks that inflation has spread “much more broadly” across the U.S. economy, resulting in an elevated threat of “persistently higher inflation.” U.S. equity markets declined on the hawkish comments. Markets also reassessed the pace they expected the Fed to raise rates as federal funds futures priced in slightly over 2 rate hikes in 2022. This reversed views in the prior two trading days that the Omicron variant would cause the Fed to slow rate hikes.

Source: Financial Times