Investment Advisory Services Featured Market Data

Bonds Break Out

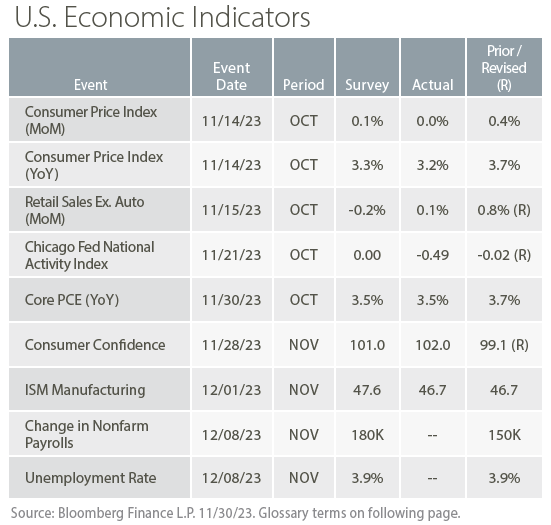

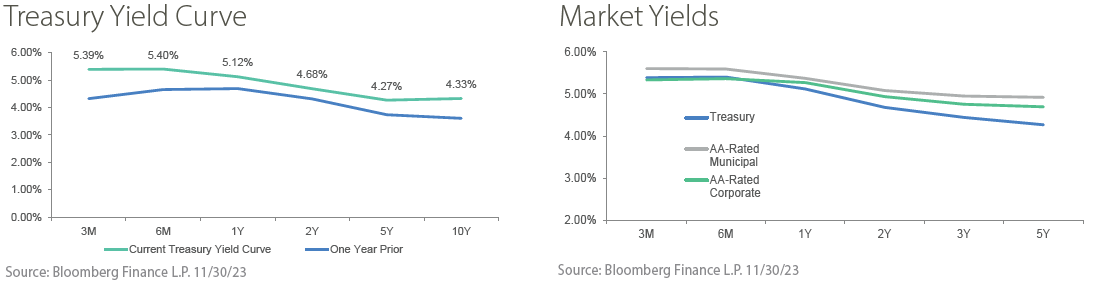

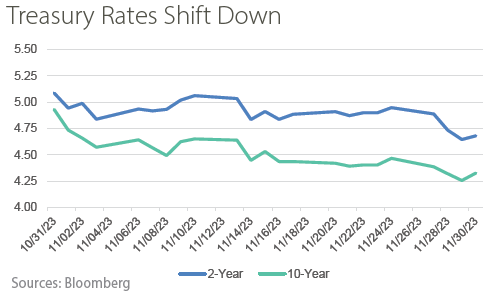

In November 2023, the Bloomberg Aggregate Index posted its strongest monthly total return since 1985. The 2-year Treasury yield ended the month at 4.70%, hitting its lowest level since mid-July. The 10-year Treasury yield ended the month at 4.34% after rising above 5.00% in October. A lower than-expected inflation print of 3.2% sparked a rally across Wall Street, with traders largely removing potential Federal Reserve rate hikes from their forecasts. In addition, the labor market showed signs of better balance adding 180,000 jobs while maintaining an unemployment rate at 3.9%. Moderately reduced employment statistics ease inflationary pressure indicating a healthier economy.

Source: Bloomberg

Investment Advisory Services Recent News

Stocks Post Strong Returns

The U.S. equity market also saw a significant rally, particularly in the S&P 500 and Nasdaq 100 indices. The S&P 500 surged 8.9% in November, marking the 7th highest monthly return since 2000. The Nasdaq Composite also performed well, climbing 10.7% over the month. November’s rally was broad-based, encompassing a wide range of stocks beyond the mega-cap “Magnificent 7” tech stocks that had dominated market gains earlier in 2023. This broad-based rally suggests a healthy market condition, where gains are not concentrated in a few sectors or companies but are spread across various industries and company sizes.

Source: FactSet