Investment Advisory Services Featured Economic Indicator

Bond Market Battles FED

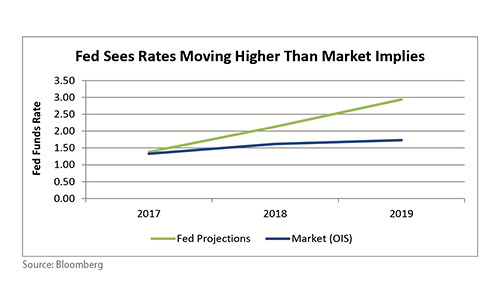

In June, Fed policymakers lifted the Fed Funds Rate to a range of 1.00-1.25% and projected one more increase this year and three more hikes in 2018. Traders in the market for fed funds futures don’t agree. They see a 57% probability that the Fed lifts rates again in 2017. Furthermore, the yield on two-year Treasury bonds implies the Fed will not raise rates over the next two years. The disagreement might stem from economic data. Inflation data has been soft, favoring bond market participants who see little inflation risk. The Fed’s own economic projections showed their preferred inflation measure is expected to come in at 1.6% in 2017, down from 1.9%. But supporting further rate hikes, the Fed’s projections for GDP increased and unemployment projections decreased.

Source: Financial Times, Wall Street Journal, Bloomberg

Investment Advisory Services Recent News

All Banks Passed FED’s Stress Test

The Fed’s stress test process, now in its seventh year, is credited for increasing bankcapital levels and for encouraging bank executives to develop better risk-management systems. All of the work appears to be paying off. The Fed approved the capital plans of all 34 banks taking part in the test. The results triggered the largest wave of U.S. bank share buyback announcements on record with $92.8 billion. On average, the banks requested payouts are near 100% of their expected earnings over the next year according to senior Fed officials, up from 65% last year. While the overall results are positive, the impact of dividend payments and share buybacks needs to be monitored.