Investment Advisory Services Featured Market Data

Steady Economic Growth

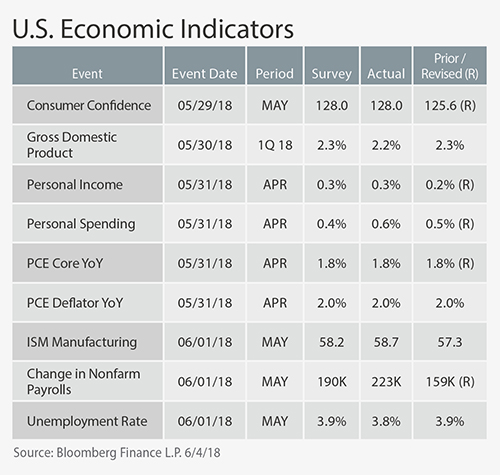

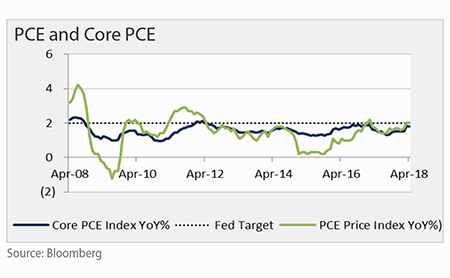

The US economy maintained a steady pace of growth during the first quarter. GDP rose at an annual rate of 2.2% driven by business investment and consumer spending. Improvements stemmed from income tax cuts and a strong labor market. Q1 2018 Consumer spending rose 1% following a robust 4% in Q4 2017. Inflation increased slightly with the PCE index up 2% in April while core PCE, excluding food and energy remained flat at 1.8%. Based on recent data, the market expects the Fed to increase interest rates in June. Our outlook calls for steady economic growth of around 2.5%. Risks include trade tensions and geopolitical concerns.

Source: Wall Street Journal, Bloomberg, Prudent Man Advisors, Inc.

Investment Advisory Services Recent News

Volatility is Back

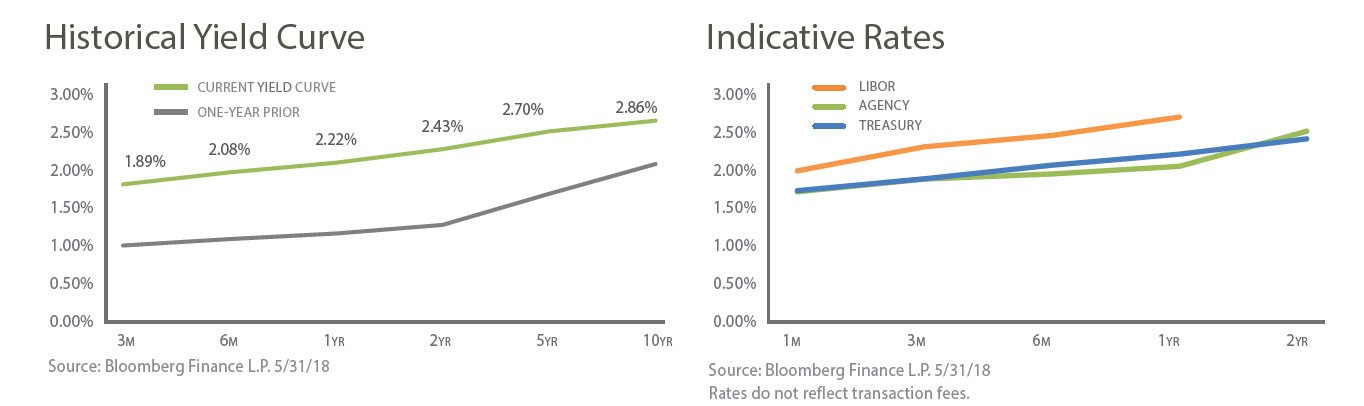

Markets experienced increased volatility arising from political developments in Italy, weakness in select emerging markets and ongoing North Korea summit discussions. A flight to quality led to a bond market rally with lower Treasury yields across the curve. The 2 Y UST yield fell 16 bps to 2.32% while the 10Y UST fell 15 bps to 2.78%, the sharpest drop since June 2016. As President Trump’s foreign policies develop, we expect volatile markets. We encourage clients to remain focused on long-term investment objectives and to implement diversified investment strategies while staying consistently invested regardless of market movements.

Source: Bloomberg, Prudent Man Advisors, Inc.