Investment Advisory Services Featured Economic Indicator

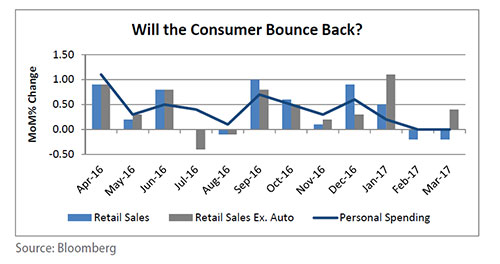

Personal Spending Slows

For two consecutive months, personal spending has been flat on a month-over-month basis. The story has been similar for retail sales and retail sales excluding auto sales. One positive note is that excluding autos, retail sales picked up in March. This was offset by the weakest annualized auto sales in over a year. Diving deeper in the data, a decrease in inflation boosted real spending to a solid 0.3% in March. This increase in real spending was lead by a rise in spending for services. Strong consumer confidence and income growth suggest the weakness is temporary.

Source: Bloomberg, www.bea.gov

Investment Advisory Services Recent news

What Does The Weak GDP Print Mean?

GDP slowed in the fist quarter to only 0.7% due to a slowdown in personal spending as described above. Other more volatile categories within GDP such as inventories and state and local government spending also contributed to the first quarter slowdown. Underneath all of this, business investment grew at a 9.4% rate last quarter, the fastest since late 2013. While investment picked up broadly, the biggest factor was a rise in mining-related structures, reflecting a rebound in the energy industry. The growth in business investment aligns with increasing business confidence and is particularly welcome after falling in 2016.

Source: Wall Street Journal, www.bea.gov