Public Finance Market Update Trends

BQ Benefit and IL Premium

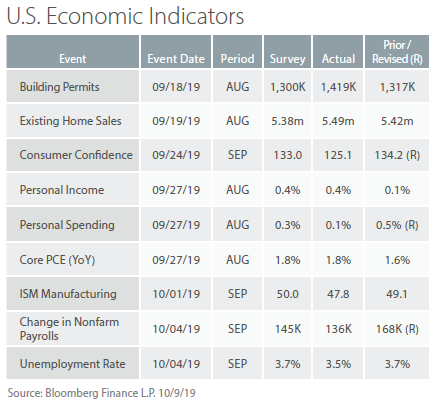

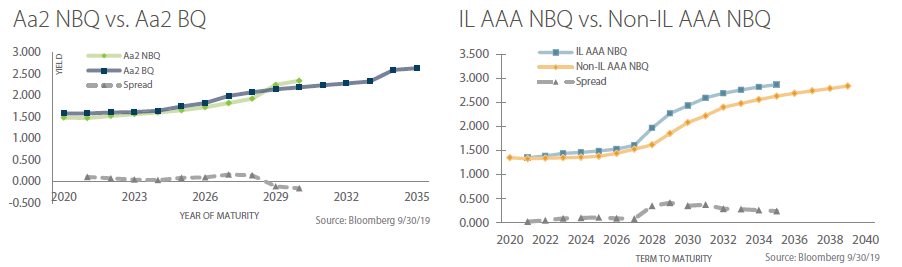

This issue focuses on two fundamental trends with a noteworthy impact to our clients. The above-left graph compares a recent non bank-qualified (NBQ) Aa2 transaction with a bank-qualified (BQ) Aa2 transaction. The BQ benefit is insignificant through the first nine years of the yield curve, but offers more value in year ten and beyond. In this case, the benefit appears to be approximately 0.15% in year 11, although the BQ benefit may not be the same in other maturity years or other bond issues.

The above-right graph shows the impact of the Illinois premium (ILP). Despite declining interest rates since 2018, the graph indicates that the ILP is as large as approximately 0.40% occurring in year ten, which doesn’t diff er greatly from recent months. While it’s not as wide as it was during the budget impasse a few years ago (approximately 0.65% or greater), there’s still a notable impact. This may indicate that investors are still penalizing Illinois issuers for the various financial challenges facing the State. It also appears that the ILP becomes more significant in year nine and beyond, suggesting that amortizing bonds shorter on the yield curve could provide incremental benefit to Illinois issuers.

Public Finance Market Update: Featured Market Data

Consumers Feeling Headwinds

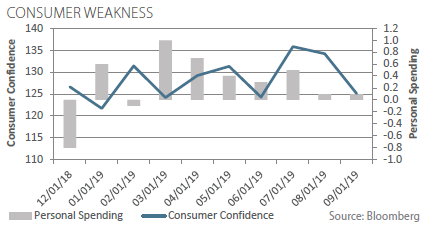

Consumer spending has trended down since March and Consumer Confidence declined in September for the second consecutive month. The decrease in Consumer Confidence reflected decreases in both the Present Situation Index and the Expectations Index. According to the Conference Board who conducts the Consumer Confidence Survey, “The escalation in trade and tariff tensions in late August appears to have rattled consumers.” Consumer spending began to trend down ahead of this turn in consumer sentiment and the trend mirrors this year’s decline in business investment.