Featured Market Data

Is Inflation Transitory?

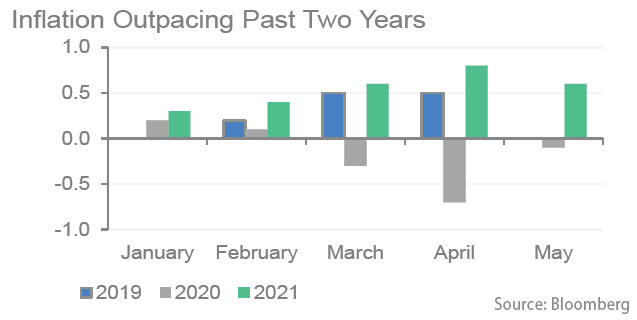

It seems inflation is on everyone’s mind. Consumers are seeing prices rise most everywhere – from the gas pump, to the grocery store and home prices. Year-to-date, CPI has risen 3.3% in 2021 compared to 1.2% in 2019 and -0.8% in 2020. Many members of the Federal Reserve are also talking about inflation risks. The base case for most economists is that rising inflation is transitory and related to supply-chain bottlenecks and low prior year comparables. Nonetheless, markets are watching closely as reopening strains and elevated demand may persist longer than anticipated. If higher prices get built into consumers’ expectations, this may add to the upward trend in wage growth.

Source: Wall Street Journal, Bloomberg

Recent News

Markets Moving

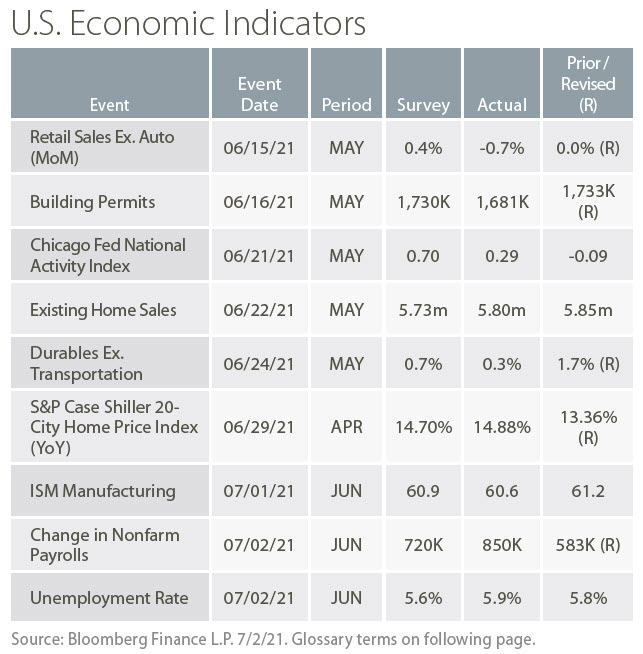

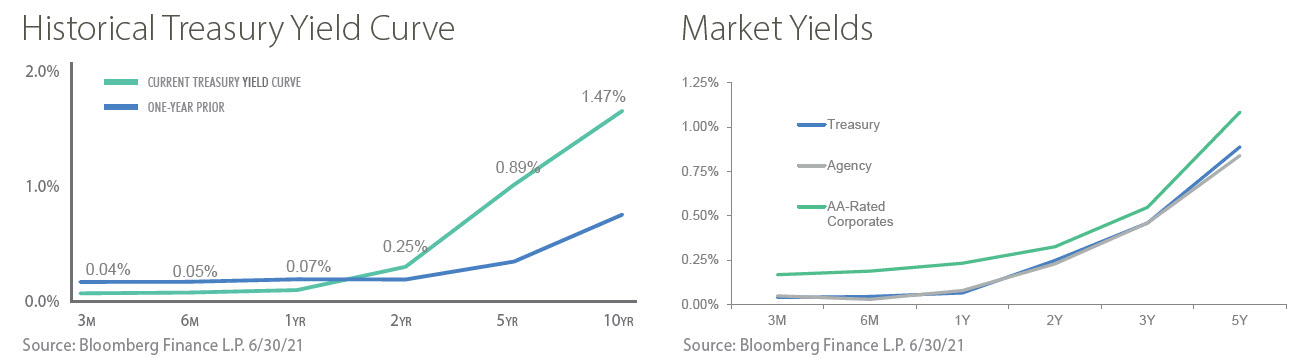

While summer is typically a quiet time for markets, bonds and stocks prices were moving in June. A more hawkish tone from the Fed in its June meeting was a large driver of price movement. The Fed signaled an earlier liftoff in 2023 compared to its prior 2024 forecast. This change in expectations along with technical shifts in Fed policy helped move 3-month and 1-year Treasury yields somewhat higher. 10-year Treasury yields declined 12 basis points for the month as investors showed more caution about growth expectations and inflation fears eased. In stock markets, the S&P 500 climbed for the 5th straight month as volatility declined. By historical comparison, volatility remains elevated signaling investors’ concerns that risks remain.

Source: Wall Street Journal, Bloomberg