Featured Market Data

Stock Valuations Level

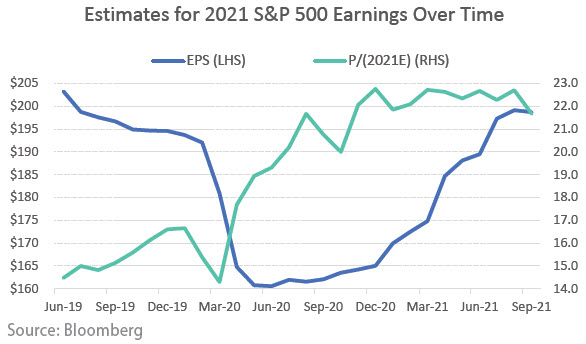

U.S. equities fell in September with the S&P 500 index posting its first decline (-4.7%) since January (-1.0%). Factors that contributed to the weak performance included concerns around Fed tapering, the complex legislative environment, persistent supply constraints, rising energy costs and concerns about a potential default of Chinese property giant Evergrande. These dynamics also drove stagflation worries, a pickup in company profit warnings and concerns for weakness in third quarter earnings. That said, corporate earnings remain solid. According to FactSet, second quarter company earnings reported in July and August were mostly positive with the S&P 500 earnings up more than 90% year-over-year, near record levels. In terms of valuation, stocks on the S&P 500 index are now trading at a multiple of 22 times forward earnings, above the 20-year average of 16 times forward earnings.

Source: FactSet

Recent News

Fed Turns Slightly Hawkish

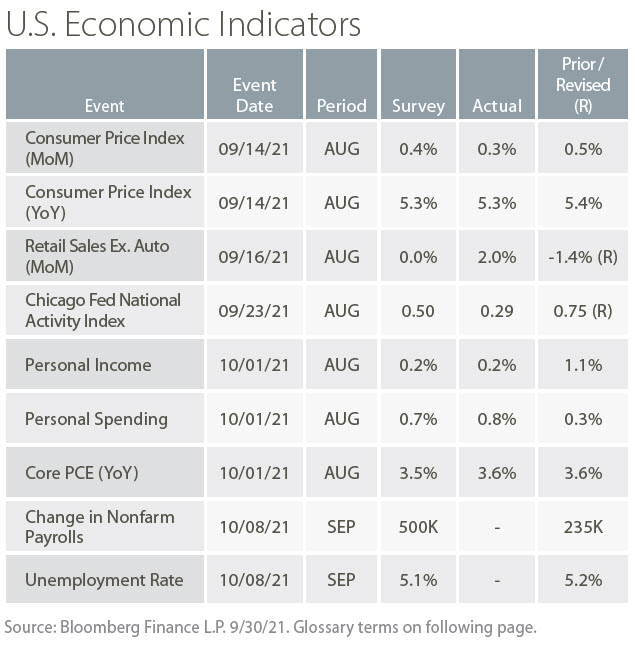

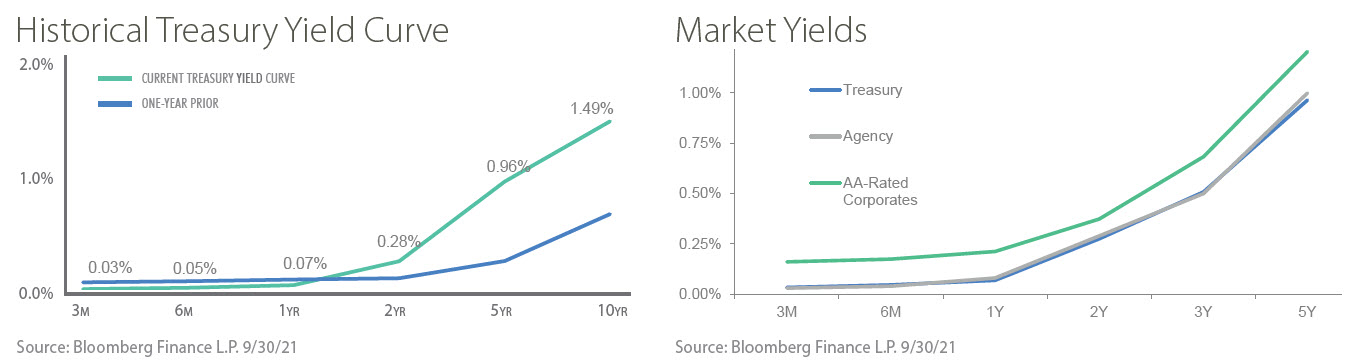

If the Fed sounded less dovish at its June meeting, it is fair to call the tone in September slightly hawkish. The Fed all but confirmed its plans to begin tapering its balance sheet in November. In addition, the median forecast for the Fed Funds rate showed a possible rate hike in 2022 and a rate near 1.00% by the end of 2023. The September meeting provided the first look at 2024 projections and additional rate hikes were projected. The Fed also updated its projections for GDP growth, employment and inflation. In line with other economists’ projections, the Fed sees lower growth in 2021 compared to its June forecast. More notably, the Fed raised inflation projections for 2021-2023 and expects inflation to remain above 2.0% through 2024.