Featured Market Data

Corporate Earnings Drive Strong Returns

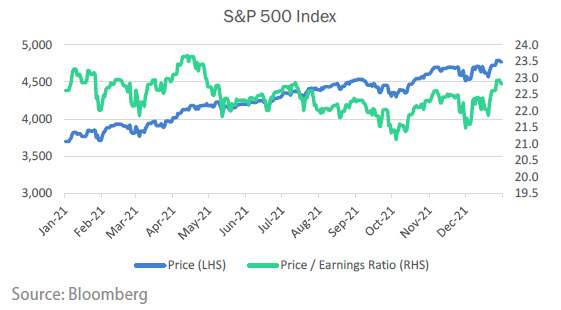

The S&P 500 rose 27% in 2021, marking a third consecutive year of double-digit gains. Price gains were supported by strong earnings growth for the year and continued healthy profit forecasts. The S&P 500 index’s valuation, measured by the price / earnings ratio, finished the year somewhat lower. The index is trading at 22.8 times analysts’ projected earnings over the next 12 months, down from 23.7 times at the end of 2020. Cheaper valuations, together with an expanding economy and low interest rates, help explain why most Wall Street forecasters predict the S&P 500 will continue to rise in 2022.

Source: Wall Street Journal, Bloomberg

Recent News

Corporate Bonds Outperform

Investment grade corporate bond spreads tightened 5 basis points in December, closing the year at an option adjusted spread of 100 basis points. These relatively tight spreads reflect strong corporate earnings and healthy balance sheets. Total return for December was -0.28%. An excess return of +0.54% for December demonstrates corporates’ stronger performance relative to Treasuries. For the year, investment grade spreads tightened 4 basis points helping generate an excess return of +1.21%. Rising interest rates resulted in a negative total return of -1.01% for investment grade corporate bonds in 2021. High yield bonds tightened 63 basis points for the year and generated a positive total return of 5.39%.

Source: Citi Market Snapshot