Featured Market Data

Economic Growth, Market Volatility

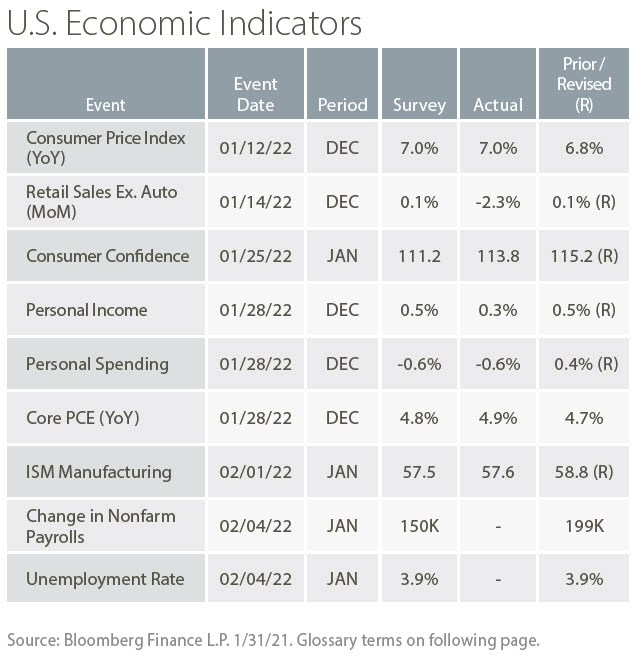

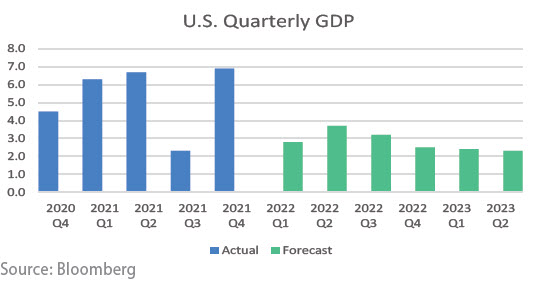

Economic data in January was largely in line with PMA’s forecast and market performance reflected our assessment that volatility may be high this year. Our base forecast was for strong economic growth and persistent inflation in 2022. Given high valuations across asset classes, we projected bouts of market volatility (both up and down) as policy and economic events unfold. We see these trends continuing throughout this year and remind our clients of the importance of a disciplined approach to investing. The chart below shows the strong GDP growth experienced in 2021 and continued healthy growth forecast in a Bloomberg survey of economists. For markets, we saw stocks sell off 5.3% in January as interest rates rose and corporate spreads widened.

Source: Bloomberg, PMA Asset Management

Recent News

Fed Liftoff Nears

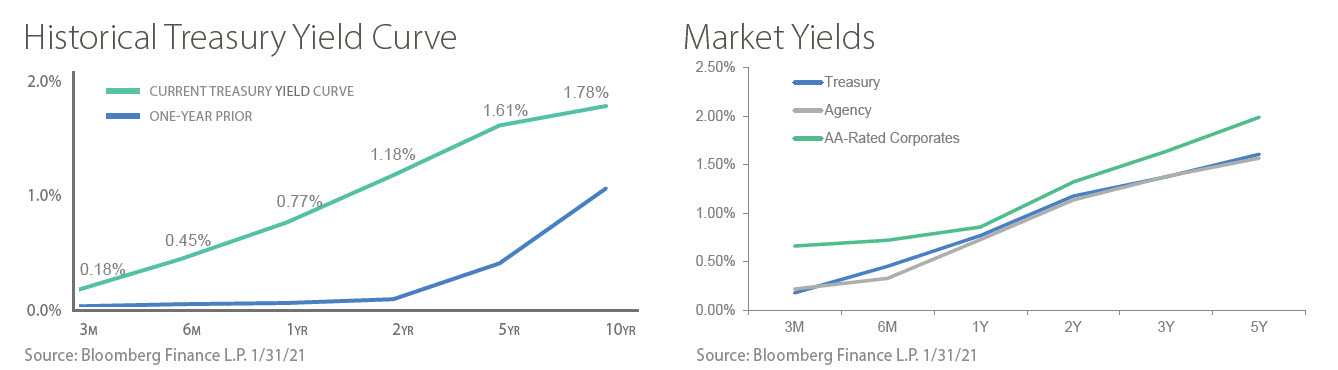

At the Fed’s January meeting, Federal Reserve Chairman Jerome Powell indicated the central bank was ready to raise rates as soon as its March meeting. Importantly, Mr. Powell said the Fed isn’t likely to offer forward guidance on the pace of hikes as he stated, “I don’t think it’s possible to say exactly how this is going to go.” This is warranted, given current uncertainty and opened the potential for hikes in consecutive meetings. The Fed has not raised rates in consecutive meetings since 2006. The central bank also approved one final round of asset purchases in March, but discussed plans to shrink the Fed’s $9 trillion securities portfolio, which unsettled markets.

Source: Wall Street Journal