Featured Market Data

War, Inflation and the Fed

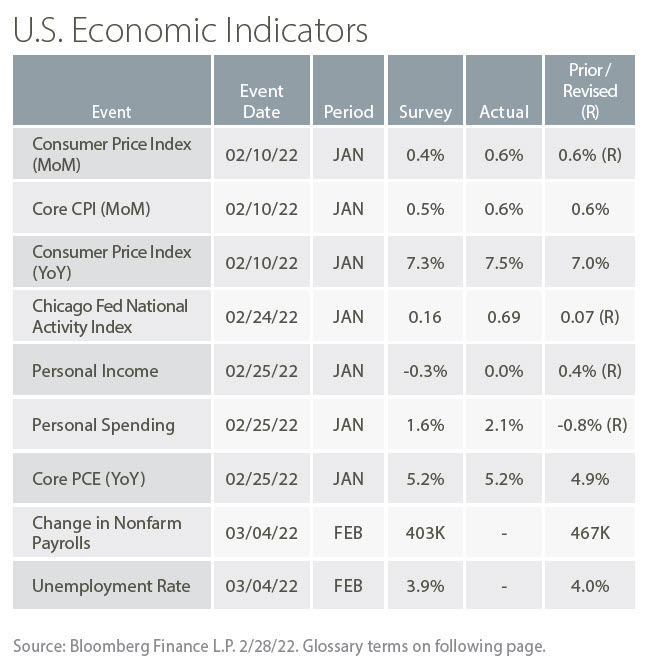

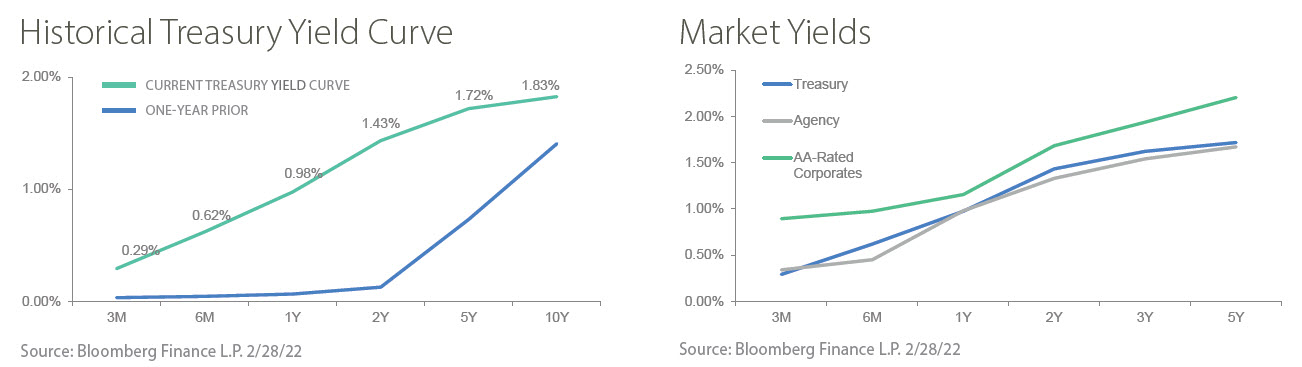

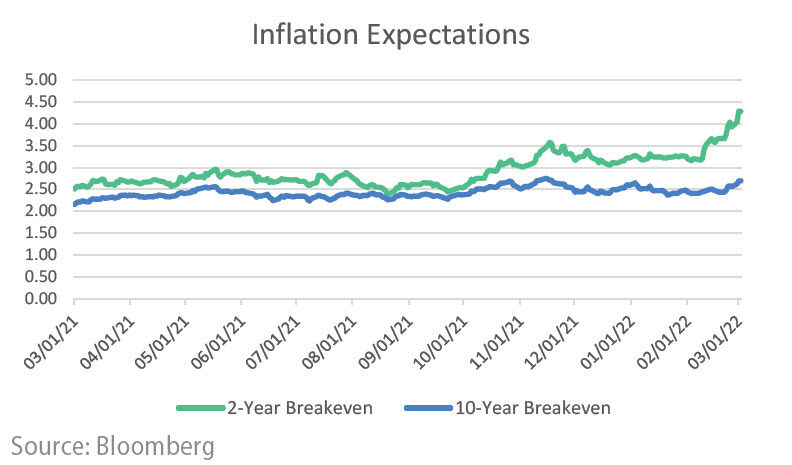

Consumer Price Inflation reached a 40-year high in January of 7.5%. Inflationary pressures increased in February as commodity prices such as oil, wheat, corn and metals rose on rising geopolitical risks, including the Russian invasion of Ukraine. We see higher inflation expectations in the Treasury Inflation Protected Securities (TIPS) market as the 2-year breakeven rate increased in February. However, the 10-year breakeven rose much less, indicating markets continue to see inflation as a relatively near-term issue. Confidence in the Federal Reserve is largely credited for these tame expectations as markets are pricing in at least four Fed rate hikes in 2022, likely beginning in March.

Source: Bloomberg

Recent News

Stocks Down in February

The S&P 500 declined 3.14% in February after a January selloff that saw the S&P 500 suffer its biggest monthly decline since March 2020. Growth once again underperformed value reflecting concerns about higher interest rates as well as geopolitical tensions. There were positive signs during the month including improvement in Covid trends, which aided some sectors benefiting from reopening. In addition, with 95% of S&P 500 companies having reported fourth quarter earnings as of February 25, 76% reported earnings per share above estimates, which is equal to the 5-year average. Company earnings reflected continued solid demand and strong pricing power. We expect the U.S. consumer to continue to support strong demand in 2022.

Source: FactSet