Featured Market Data

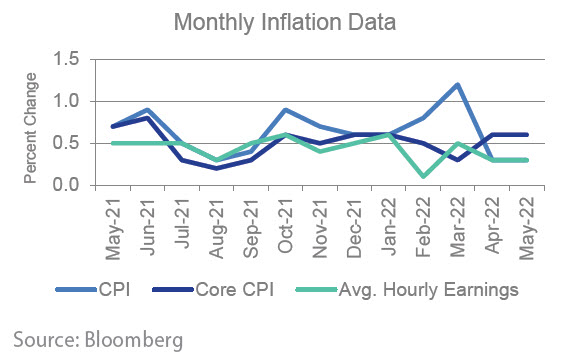

Past Peak Inflation?

Headline CPI declined to 8.3% in April from 8.5% in March as energy prices eased. This helped fuel expectations that inflation has peaked. Inflation breakevens, a forward-looking measure of inflation, have mostly declined since peaking in March. The picture is less clear as we analyze monthly inflation data. On the positive side, month-over-month CPI has been lower the past two months at 0.3% compared to growth as high as 1.2% in March. Average hourly earnings growth of 0.3% in April and May was also viewed positively. Conversely, Core CPI, which excludes more volatile food and energy costs, remained elevated at 0.6% the past two months. Meanwhile, energy prices have risen in May placing upward pressure on headline inflation data.

Source: Bloomberg

Recent News

Management Talking Inflation

While operating margins have held up relatively well for S&P 500 companies despite inflation reaching a 40-year high during the first quarter, sentiment is turning negative. A Bloomberg analysis of 1Q earnings calls showed management teams of S&P 500 companies mentioned “inflation” more than five times per call on average. Moreover, management answers to analyst questions have progressively become less optimistic since 2Q21. Forecasts imply six of nine S&P 500 sectors will post operating margin declines year-over-year in 2Q. Forward earnings forecasts revisions are trending lower for the remainder of 2022, reflecting expectations for high inflation to reduce margins.

Source: Bloomberg