Featured Market Data

Fighting Inflation

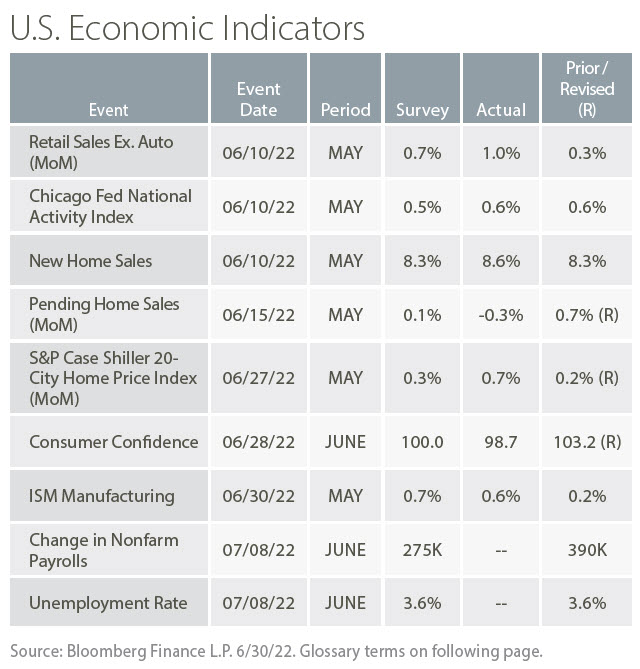

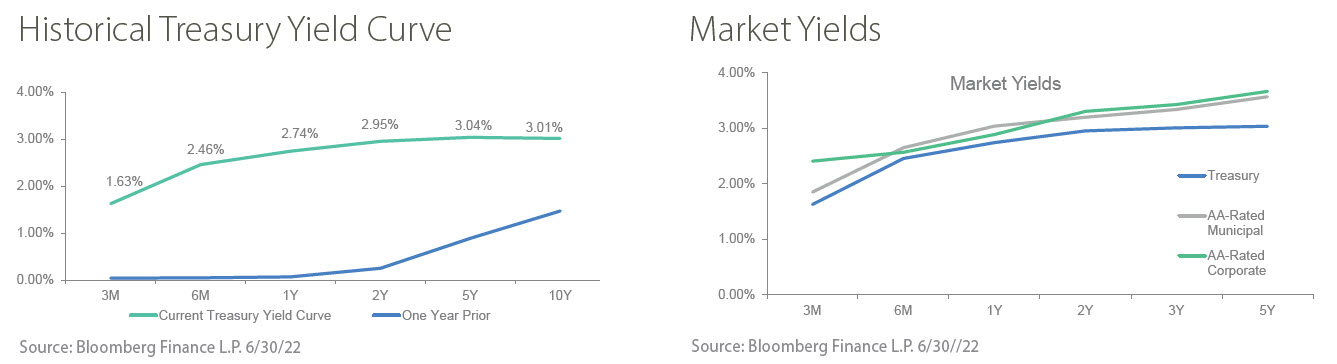

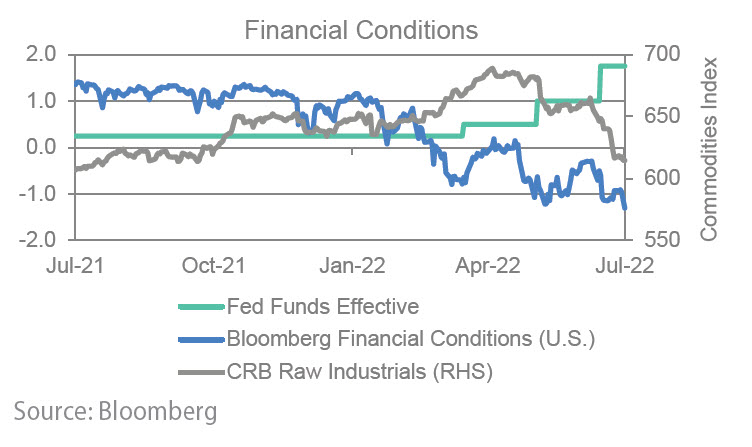

The Federal Reserve further expanded efforts to reduce inflation in June through a 75 basis point rate hike and hawkish Fed speak. Federal Reserve Chairman Jerome Powell was clear during Congressional testimony that the Fed is committed to price stability. He added that tighter monetary policy is slowing growth, which narrows the path to a soft landing and creates the risk of a recession. We have seen financial conditions tighten all year, well in advance of the first Fed rate hike in March. June data showed the impact of tighter financial conditions as retail sales, home sales and commodity prices declined. This softening should help reduce inflationary pressures.

Source: Bloomberg

Recent News

Markets Down in June

Stocks declined and credit spreads widened in June following a market rebound at the end of May. Sentiment turned negative when the May CPI report showed inflation above expectations. The following week, the Fed changed course from its widely discussed plan and hiked rates 75 basis points. The large rate hike increased market concerns of a recession and lower corporate earnings. For the month, the S&P 500 finished lower by about 8.4% and the Nasdaq was lower by 8.7%. Fixed income also struggled with rates and spreads higher. Investment grade and high yield spreads were higher by 25 and 163 basis points, respectively.

Source: Bloomberg