Featured Market Data

Fed Higher for Longer

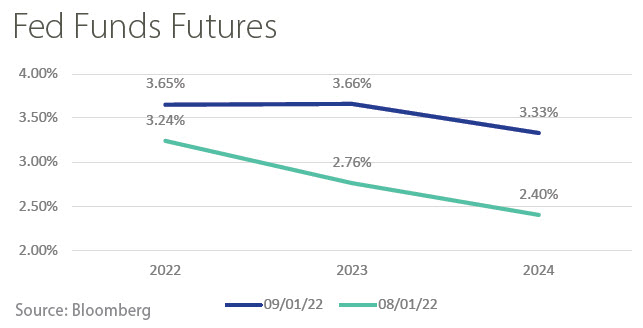

In a speech in Jackson Hole, Wyoming on August 26, Fed Chair Jerome Powell emphasized the importance of reducing inflation. He said the Fed would continue raising rates and hold them higher until it is confident inflation is under control. This pushed up market expectations for where the Fed Funds rate will be at the end of 2022, 2023 and 2024. Leading up to Powell’s speech, multiple Fed members pushed back against some investors’ expectations that the Fed may quickly “pivot” in 2023 to cutting interest rates as the economy slows. In his Jackson Hole speech, Powell pointed to the policies of the 1970’s and said, “The historical record cautions strongly against prematurely loosening policy.”

Source: Wall Street Journal

Recent News

Employment Remains Strong

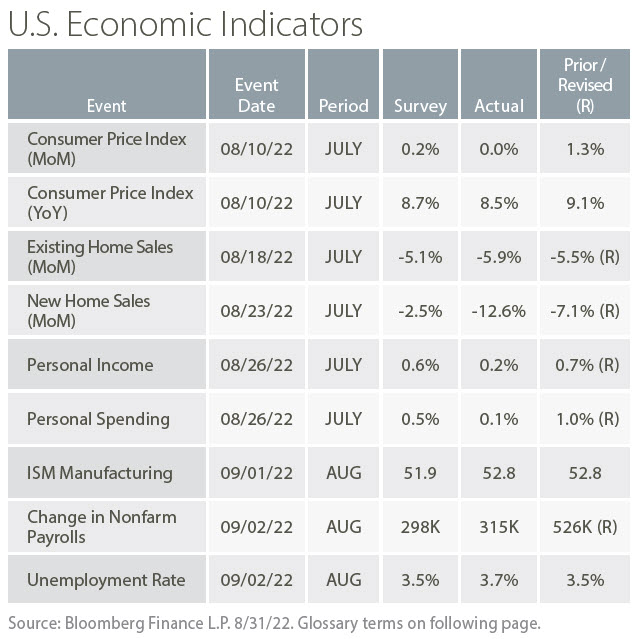

Employers added 315,000 jobs in August. While the pace was down from July’s revised 526,000 jobs, growth remained well above the pre-pandemic trend. Unemployment rose slightly to 3.7% from 3.5% in July as more workers entered the work force. The employment report also showed hourly earnings rose 5.2% in August from a year earlier, a level equal to the prior month. The employment report reflects a continued tight labor market and should keep the Fed on track to raise rates by 0.50% or 0.75% later this month.

Source: Wall Street Journal