Featured Market Data

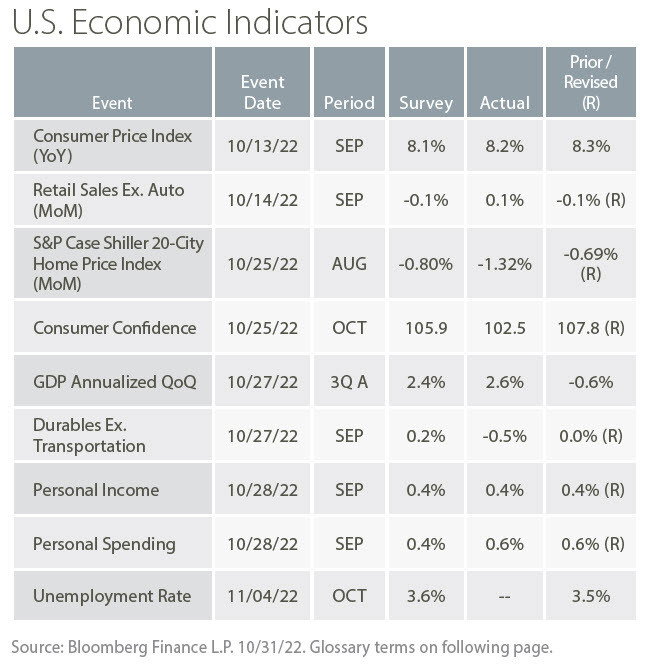

Inflation Pressures Cool Slightly

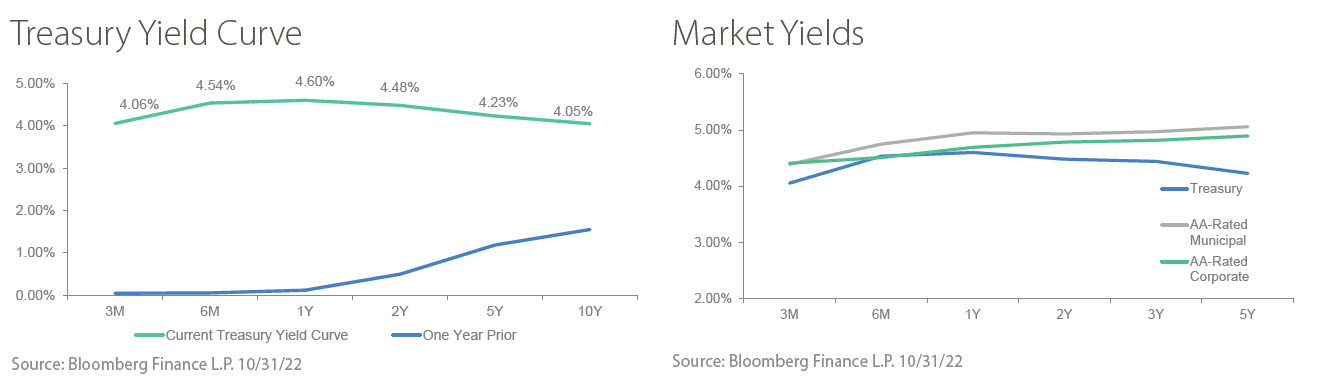

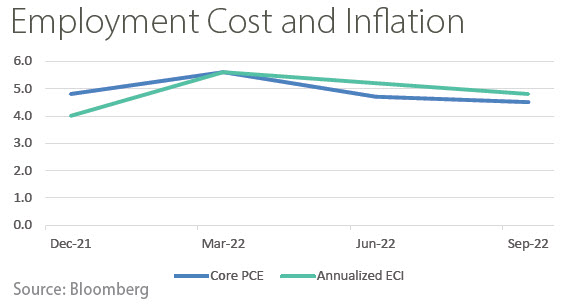

The market widely anticipates the Federal Reserve will hike rates by another 75 basis points on November 2. The question on the market’s mind is what they will do in December and what will be the terminal Fed Funds rate. Consecutive quarters of decreases in inflation as measured by the Personal Consumption Expenditures Index excluding food and energy (Core PCE) and declines in the Employment Cost Index (ECI) may offer the Fed the ability to reduce the hike to 50 basis points in December. While these trends are positive, the Fed still has a lot of work to do in its battle to reduce inflation. Persistent inflationary pressures have pushed the market’s expected terminal Fed Funds rate up to approximately 5% in 2023.

Source: Wall Street Journal

Recent News

Earnings in Focus

Higher interest rates have led investors to favor companies that generate positive income and cash flow. This focus on earnings has benefitted value stocks and pressured growth stocks including those in the technology and communication sectors. Overall 3rd quarter earnings growth for S&P 500 companies was rather low at 2.2% through October 28 and below the 2.8% growth expected at September 30. Earnings guidance is also particularly in focus. Analysts’ estimates for 4th quarter earnings for firms in the S&P 500’s communication services sector, including Facebook and Google, have fallen sharply and stock prices for the sector have declined commensurately.

Source: Wall Street Journal