Featured Market Data

Fed and Inflation Driving Markets

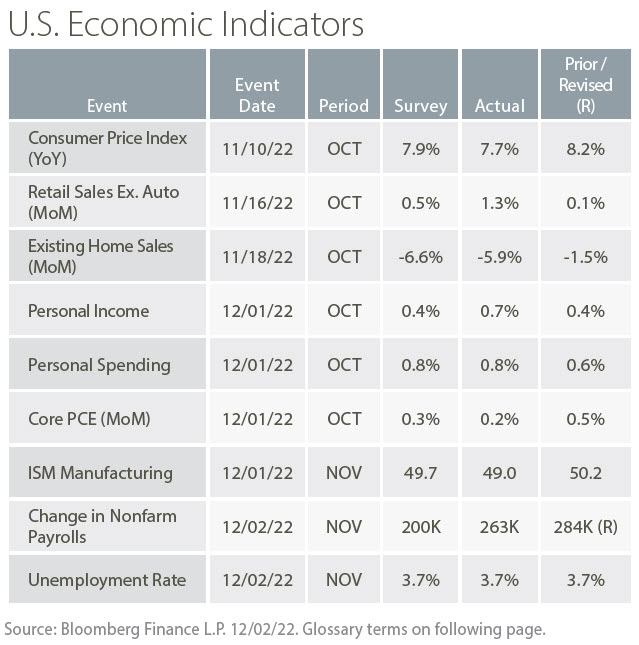

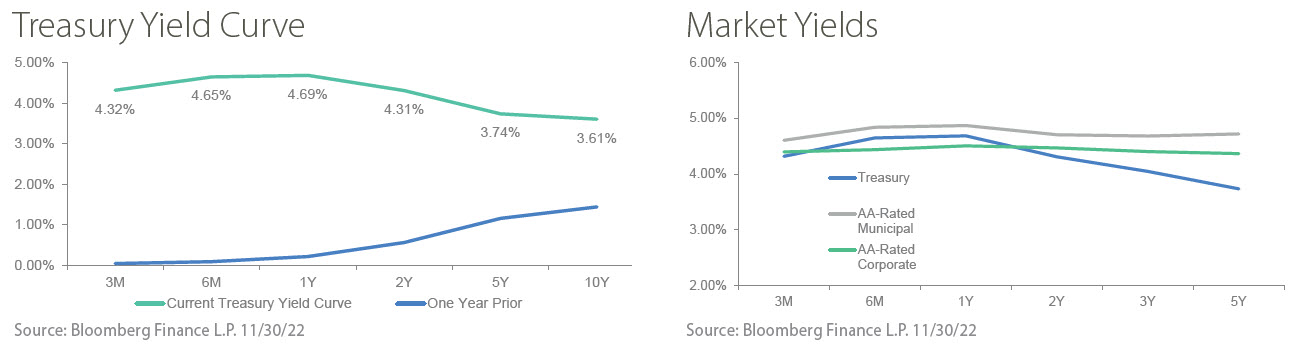

Stocks rallied in November on softer inflation data and expectations for the Fed to slow the pace of rate hikes beginning in December. Together, the news helped lift the S&P 500 index 5.38% for the month. This marked the first time since August 2021 that the S&P 500 saw back-to-back monthly gains. While Fedspeak in November emphasized themes of more hikes and rates higher for longer, the market increasingly focused on the potential for a Fed “pivot” following the softer CPI report on November 10. The Fed remains data dependent and we expect the market to continue to wrestle with the implications of each new piece of economic data.

Source: Bloomberg

Recent News

Strong Labor Market

Job growth remained strong in November as the economy added 263,000 jobs, well ahead of forecasts for 200,000 new jobs. Leisure and hospitality, health care, and government saw gains as employment declined in retail trade and in transportation and warehousing. The unemployment rate was unchanged at 3.7%, in line with expectations. The labor force participation rate ticked down to 62.1 percent and is 1.3 percentage points below its February 2020 level. In a worry for the Fed as it battles inflation, wages grew 5.1% from a year earlier. Low unemployment and wage gains are helping fuel consumer spending which is likely to support further price growth of goods and services.

Source: www.bls.gov, Wall Street Journal