Featured Market Data

Tighter Financial Conditions Slow Growth

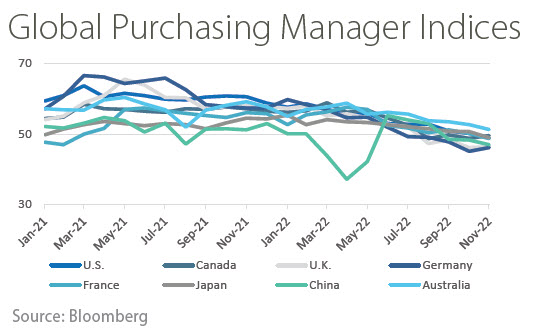

During 2022, global central banks tightened monetary policy in an effort to combat heightened inflation. This tightened financial conditions and has resulted in manufacturers slowing production globally. In the U.S., economic activity in the manufacturing sector contracted in November for the first time since May 2020 and the index remained below 50 in December. The survey has reported softening new order rates over the previous six months. Overall, the declining trend reflects companies preparing for future lower output. A similar trend can be seen in falling purchasing manager indices for manufacturers across major economies.

Source: www.ismworld.org, Bloomberg

Recent News

Value Stocks Outperformed Growth in 2022

The Fed’s rate hikes in 2022 were a primary driver of lower stock prices, along with slowing economic growth, EPS contraction and inflation pressures. The S&P 500 was down 18.1% for the year. Value stocks outperformed in 2022 due to their comparative lack of sensitivity to rate movements. The Russell 1000 Value was down just 7.5%. The magnitude of outperformance for value, as demonstrated by the 24.2% difference in returns for the S&P 500 growth and value indices, was a level not seen since 2000. Looking forward, slower economic growth may present continued opportunities for value versus growth stocks in the next 12-18 months.

Source: FactSet