Featured Market Data

Stronger Data Help Lift Rates

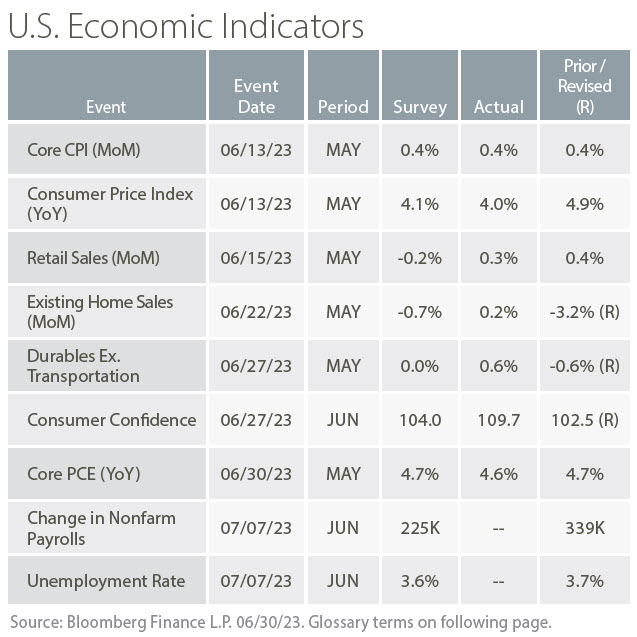

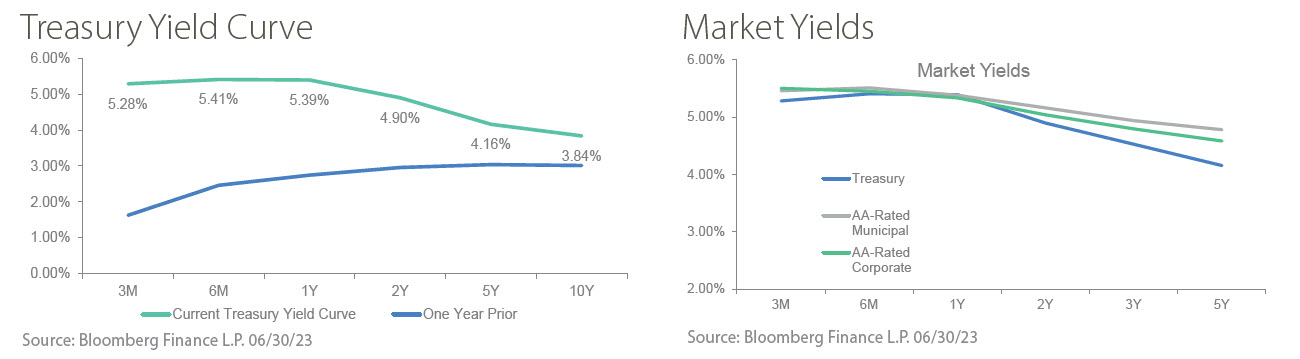

Economic data was mostly stronger than expected in June. The Citi Economic Surprise Index, which measures the differences in actual and forecasted economic data, rose in June as data such as retail sales, consumer confidence and durable goods orders were all stronger than expected. Stronger data also helped lift interest rates as 1-year and 2-year U.S. Treasuries increased by 22 and 49 basis points, respectively, in June. At the same time, futures markets fully priced in one additional Fed Funds rate hike in 2023 while eliminating expectations for a cut this year. During its June meeting, the Fed did not raise rates but conveyed expectations for two more rate hikes this year.

Source: Bloomberg

Recent News

Federal Reserve and Growth

With inflation slowly declining and labor markets strong, we see the Fed as increasingly focused on economic growth as it contemplates further rate hikes. The Bureau of Economic Analysis (BEA) released its third estimate of 1st quarter GDP on June 29th. GDP was revised up to 2.0% from 1.3% in the second estimate based on upward revisions to exports and consumer spending that were partly offset by downward revisions to business investment and federal government spending. Surveys of economists forecast the potential for GDP to turn negative in the second half of 2023. Given strong recent data, we see a continued trend of recession risks being pushed back.

Source: www.bea.gov