Featured Market Data

Markets Rally on Dovish Fed

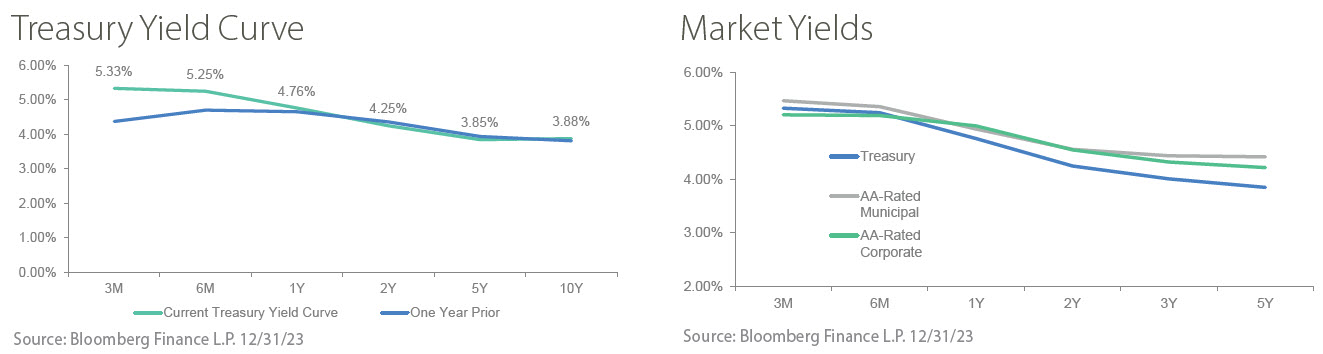

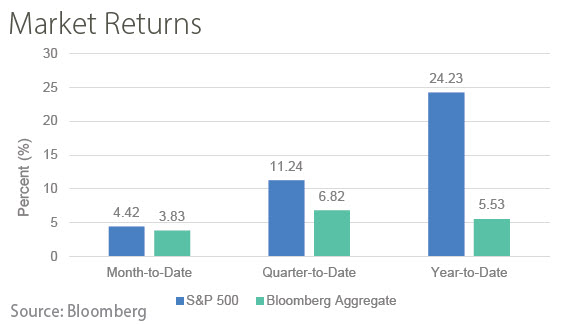

Stocks and bonds continued to rally in December resulting in strong returns for equity and fixed income markets in 2023. Favorable economic data increased expectations in early December that the Fed would begin to pivot toward lower rates. Fed officials confirmed this at the December Fed meeting as the Summary of Economic Projections showed three 0.25% rate cuts expected in 2024. Fed Chair Jerome Powell noted that the timing of rate cuts would be the Fed’s “next question.” The Fed pivot helped to send yields lower as the market priced in at least six 0.25% rate cuts in 2024. Lower yields and investors’ shift out of large cash positions aided bond returns and fueled further gains in equity markets.

Recent News

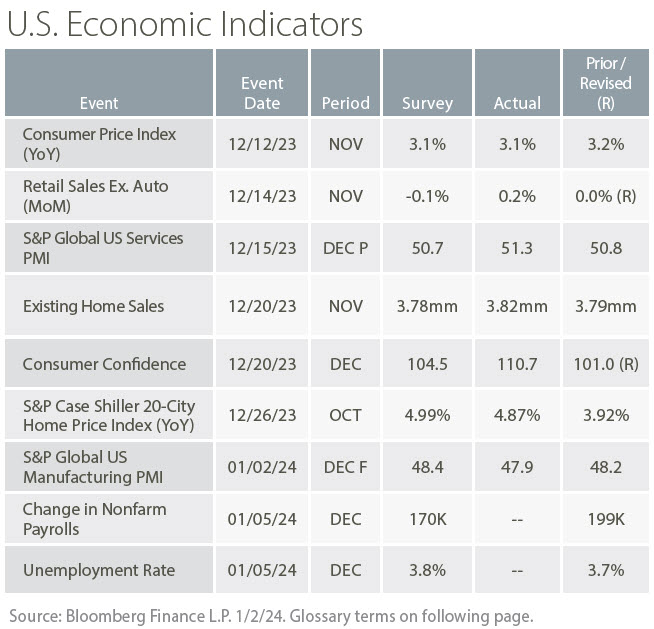

Inflation Slows

Economic data released in December was supportive of slowing inflation. The employment report showed average hourly earnings fell to the slowest annualized pace since June 2021. Headline CPI fell for the month to 3.1% and the Fed’s preferred measure of inflation, Core Personal Consumption Expenditures (PCE), also slowed and was revised down for prior months. December Michigan Consumer Sentiment displayed 1-year inflation expectations the lowest since March 2021. Altogether, the data supports a Fed pivot toward lower rates in the year ahead. It is a good time for investors to ensure their portfolios are invested to meet expected liabilities.