Featured Market Data

A Mixed Bag of Data

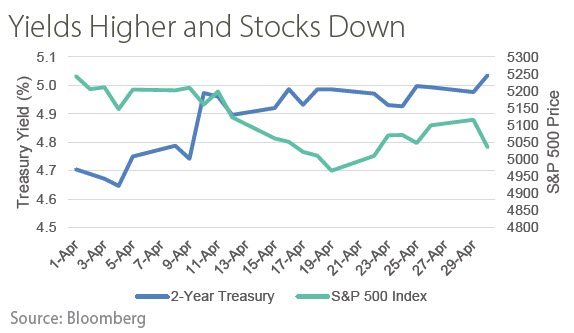

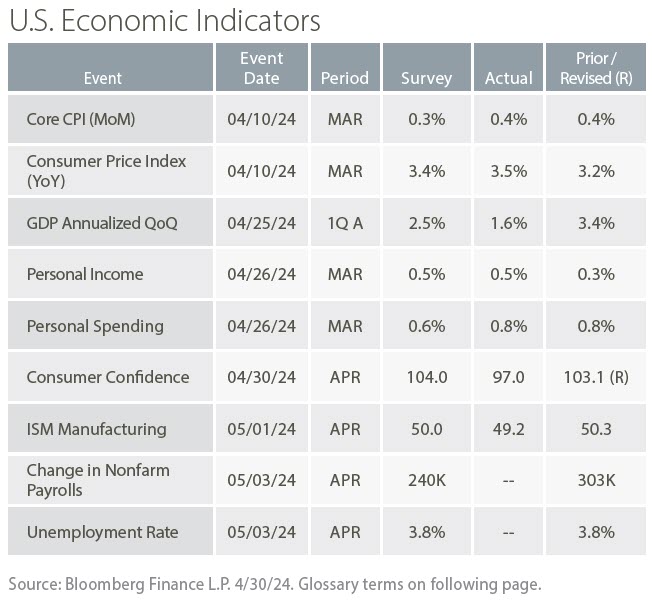

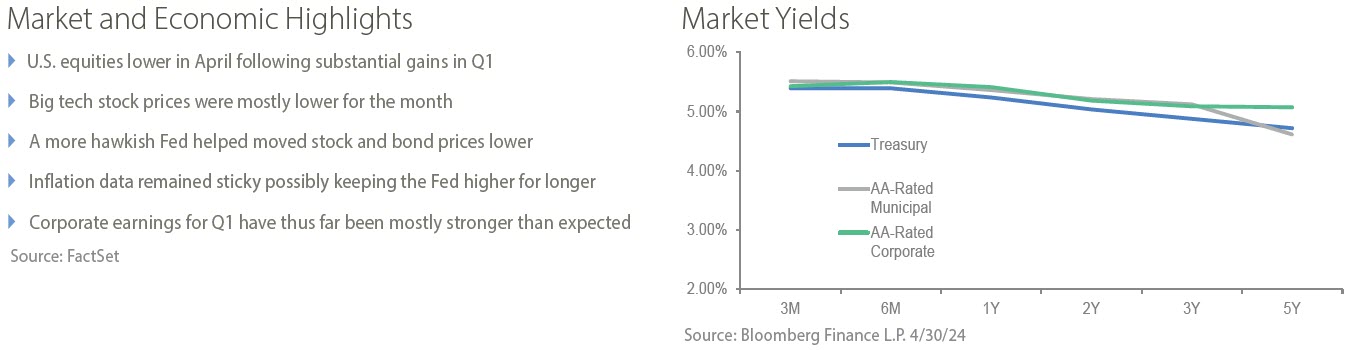

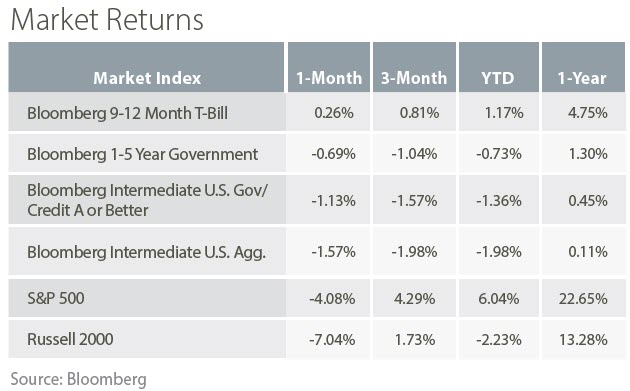

Inflation, employment and GDP growth data received in April all contributed to declines in stock and bond prices. During April, Fedspeak focused on patience with respect to a potential rate cut. In his press conference following the May 1, 2024, FOMC meeting, Federal Reserve Chairman Powell noted a “lack of further progress” regarding inflation data, while reiterating that policy remains sufficiently restrictive. A higher for longer narrative returned when March CPI came in higher than expected for the third consecutive month. Regarding economic growth, March nonfarm payrolls were higher than consensus, potentially contributing to inflation. 1st quarter GDP, meanwhile, was below expectations. Softer GDP growth renewed attention to the possibility of a bumpy landing. Stronger than expected Q1 earnings remain a bright spot for markets.

Source: Bloomberg